Choosing the right accounting software is crucial for businesses in the UK. The right tool can streamline financial processes, ensure compliance with UK tax laws, and provide valuable insights into your financial health. With so many options available, how do you determine which one is best for your business? What features matter most? And which platforms are trusted by other businesses in the UK?

To help you decide, we’ve thoroughly researched and compared the top accounting software options available for 2025. We’ve considered usability, pricing, features, integrations, and real user feedback to bring you this comprehensive list. Let’s dive in and explore the best accounting software solutions in the UK.

Top 15 Best Accounting Software in the UK for 2026

Here’s a quick summary of the top picks for 2026:

- Sage Accounting – Best overall for small businesses

- Xero Accounting – Best for growing businesses with multi-user access

- FreshBooks – Best for freelancers and small service-based businesses

- Firstbase Accounting – Best for ease of use and automation

- Dext Prepare – Best for receipt and invoice management

- TaxCycle – Best for tax-focused accounting

- SAP – Best for large enterprises and global businesses

- FreeAgent – Best for freelancers and contractors

- QuickBooks – Best for simplicity and scalability

- NetSuite – Best for enterprise-level financial management

- Crunch Accounting – Best for simple and affordable bookkeeping

- Oracle NetSuite EMEA – Best for large international businesses

- Reach – Best for integrated accounting and business management

- ORION ERP – Best for ERP systems with accounting functionalities

- MProfit for Accounting – Best for investment and portfolio accounting

Now, let’s dive deeper into each of these accounting tools to help you find the one that best suits your business.

Questions to Ask When Choosing the Right Accounting Software for Your Business:

- Does your business need to handle multiple currencies or tax systems?

- How important is it for the software to integrate with your existing tools?

- Do you need mobile access or cloud-based features for remote work?

- What type of customer support and training does the software offer?

- How scalable is the software as your business grows?

We’ve reviewed over 40 accounting tools, analyzing user feedback, compliance with UK regulations, ease of use, and affordability. After extensive testing and research, here are the top 15 accounting software solutions for UK businesses in 2025.

How This Top 15 List Was Created

Our team evaluated a range of accounting platforms, focusing on the following criteria:

- Pricing models: Whether software charges per user, based on team size, or offers tiered plans.

- Features and compliance: Ensuring the software supports UK-specific tax laws, including VAT management, and integrates seamlessly with other tools like payroll.

- User feedback: Real reviews from businesses across the UK on ease of use, customer service, and reliability.

We considered the needs of both small startups and growing enterprises, ensuring we included software that can handle everything from basic invoicing to complex tax filing and financial reporting.

Pricing Comparison for Small Teams and Startups

For small teams or startups, affordability is crucial. Software like Timetastic or Buddy Punch can cost as little as £1–£2 per user per month, offering essential features such as invoicing, time tracking, and absence management without unnecessary complexities.

Pricing Comparison for Growing SMEs and Enterprises

As your business expands, you’ll likely need more advanced features. Solutions like Sage People, Personio, and BrightHR cater to growing businesses with scalable pricing models, starting at around £5–£12 per user per month. These tools come with added functionalities like legal compliance, multi-user support, and performance tracking.

For enterprise-level solutions, platforms like Oracle NetSuite and SAP offer powerful features but come with higher pricing tailored to global operations and large-scale businesses.

1. Sage Accounting – Best Overall for Small Businesses

Sage Accounting is a well-established name in the accounting software industry, offering a range of solutions tailored to small businesses. Known for its reliability and comprehensive features, Sage is ideal for businesses looking for both simplicity and functionality. It provides tools for invoicing, expense tracking, VAT management, and financial reporting. Sage is particularly useful for companies that need scalable solutions that can grow as their business expands.

Reviews:

Users appreciate Sage’s ease of use and the wide range of features it offers. It’s known for strong customer support, making it a trusted choice for small businesses across the UK.

Key Features:

- Invoicing and expense tracking

- Real-time financial reporting

- Multi-currency support

- Integration with payroll services

- Easy VAT calculation and filing

Pros:

- User-friendly interface

- Scalable for growing businesses

- Strong UK tax compliance features

Cons:

- Can become expensive as business needs grow

- Some users find it lacks advanced reporting capabilities

Ideal For: Small businesses seeking a comprehensive, reliable accounting solution.

2. Xero Accounting – Best for Growing Businesses with Multi-User Access

Xero Accounting is a cloud-based solution that offers a wide range of features suitable for small to mid-sized businesses. It is particularly well-known for its ease of use, powerful reporting tools, and multi-user access capabilities. Xero’s collaboration features make it ideal for businesses with multiple team members involved in accounting processes.

Reviews:

Xero is highly rated for its ease of use and seamless integration with other apps. Customers also highlight its mobile-friendly interface, which makes managing finances on the go easy.

Key Features:

- Multi-user access

- Customizable invoices and quotes

- Bank reconciliation and transactions

- Payroll and time tracking integrations

- Financial forecasting and reporting

Pros:

- Great for collaboration with multiple users

- Extensive app marketplace for added functionality

- Excellent customer support

Cons:

- Advanced features are only available in higher pricing tiers

- Can be overwhelming for absolute beginners

Ideal For: Growing businesses with multiple users who need to collaborate on accounting tasks.

3. FreshBooks – Best for Freelancers and Small Service-Based Businesses

FreshBooks is an easy-to-use accounting software designed for freelancers and small service-based businesses. Its simple interface and features like invoicing, expense tracking, and time tracking make it an excellent choice for individuals and teams with basic accounting needs.

Reviews:

FreshBooks users love its user-friendly interface and fast setup time. The software is ideal for freelancers who need to manage their business expenses and keep track of payments.

Key Features:

- Professional invoicing and quotes

- Time tracking and project management

- Expense management

- Client and vendor management

- Mobile app for accounting on the go

Pros:

- Simple and easy to use

- Great for freelancers and contractors

- Strong customer support

Cons:

- Limited features compared to more advanced accounting software

- Pricing can be expensive for freelancers with growing needs

Ideal For: Freelancers and small businesses who need basic, easy-to-use accounting tools.

4. Firstbase Accounting – Best for Ease of Use and Automation

Firstbase Accounting is designed for businesses that want to automate their accounting processes. Its user-friendly platform helps companies automate repetitive tasks like invoicing, expense tracking, and tax calculations. Firstbase’s automation capabilities save time and reduce the chance of errors in the financial process.

Reviews:

Firstbase users appreciate the software’s ease of use and the ability to automate tasks, reducing the manual workload. However, some users feel that it could benefit from more integrations.

Key Features:

- Automated invoicing and expense tracking

- Tax calculations and filings

- Customizable financial reports

- Mobile access and cloud storage

- Integration with payment gateways

Pros:

- Strong automation features

- Easy to set up and use

- Good for businesses with repetitive accounting tasks

Cons:

- Limited integrations with third-party apps

- Some advanced features are missing

Ideal For: Businesses seeking an automated, time-saving accounting solution.

5. Dext Prepare – Best for Receipt and Invoice Management

Dext Prepare (formerly Receipt Bank) is an accounting software solution focused on automating receipt and invoice management. It’s perfect for businesses that need to capture receipts and invoices digitally, categorize them, and integrate them into their accounting system.

Reviews:

Users love Dext Prepare for its ability to quickly scan and categorize receipts, saving time on manual data entry. It integrates seamlessly with popular accounting software like Xero and QuickBooks.

Key Features:

- Receipt and invoice scanning and data extraction

- Integration with major accounting platforms

- Real-time financial reporting

- Customizable categorization

- Multi-currency support

Pros:

- Fast and accurate receipt scanning

- Integrates with other popular accounting software

- Reduces manual data entry

Cons:

- Pricing may not be suitable for very small businesses

- Some users report issues with the mobile app

Ideal For: Businesses needing efficient receipt and invoice management.

6. TaxCycle – Best for Tax-Focused Accounting

TaxCycle is a comprehensive accounting software designed specifically for tax preparation and filing. It offers a wide range of tax tools, including automated calculations, tax forms, and client portals. TaxCycle is ideal for accountants and tax professionals handling tax returns and VAT calculations.

Reviews:

TaxCycle is praised for its in-depth tax capabilities and integration with tax authorities. It’s highly recommended for accountants dealing with complex tax scenarios.

Key Features:

- Tax return preparation and filing

- Automated tax calculations

- VAT and compliance features

- Client portals for document sharing

- Detailed reporting for tax filings

Pros:

- Excellent tax-specific features

- Automates tax calculations and filing

- Ideal for accountants and tax professionals

Cons:

- Steep learning curve for new users

- Not as suitable for businesses that don’t require heavy tax features

Ideal For: Accountants and tax professionals needing comprehensive tax tools.

7. SAP – Best for Large Enterprises and Global Businesses

SAP is a leading provider of enterprise resource planning (ERP) software that includes advanced accounting features for large businesses. With SAP, companies can manage everything from procurement to financial management and reporting. It’s a powerful tool for businesses operating across multiple countries and industries.

Reviews:

SAP is highly regarded for its robust capabilities, especially for large businesses with complex needs. Users appreciate its flexibility and the level of customization available but mention that it requires significant implementation time.

Key Features:

- Financial planning and reporting

- Multi-currency and multi-country support

- Integration with other ERP modules

- Real-time financial insights and analytics

- Advanced compliance features

Pros:

- Highly customizable and flexible

- Great for global businesses

- Strong reporting and analytics tools

Cons:

- Expensive and complex setup

- Steep learning curve for new users

Ideal For: Large enterprises with complex global accounting needs.

8. FreeAgent – Best for Freelancers and Contractors

FreeAgent is a cloud-based accounting software designed for freelancers, contractors, and small businesses. It’s known for its user-friendly interface and is particularly popular among UK-based freelancers who need to manage invoicing, expenses, and taxes.

Reviews:

FreeAgent is highly rated for its ease of use, particularly by freelancers and contractors. It’s praised for being tailored to the UK market and for its strong support for tax-related features.

Key Features:

- Invoicing and quotes

- Bank reconciliation

- Self-assessment and tax filing

- Time tracking and expense management

- Integrated project management

Pros:

- Specifically designed for freelancers and contractors

- Easy to use with UK tax features

- Comprehensive reporting tools

Cons:

- Limited features for growing businesses

- Some users report slow customer support

Ideal For: Freelancers and small businesses looking for a simple and affordable accounting solution.

9. QuickBooks – Best for Simplicity and Scalability

QuickBooks is one of the most popular accounting software solutions globally and has a strong presence in the UK. Known for its simplicity and scalability, QuickBooks is suitable for businesses of all sizes, from freelancers to large enterprises. Its features include invoicing, expense tracking, tax calculations, and reporting, all within a user-friendly interface.

Reviews:

QuickBooks is widely praised for its ease of use, with many users noting that it simplifies the accounting process. The ability to scale with growing businesses is another benefit, though some users have mentioned that advanced features are only available in higher-tier plans.

Key Features:

- Invoicing and bill management

- Bank reconciliation

- Payroll integration

- Financial reporting and forecasting

- Multi-user access

Pros:

- User-friendly interface

- Scalable for businesses of all sizes

- Strong reporting features

Cons:

- Pricing can be expensive as you scale

- Limited customization options on lower-tier plans

Ideal For: Small to medium-sized businesses looking for an easy-to-use accounting solution that can scale.

10. NetSuite – Best for Enterprise-Level Financial Management

NetSuite, part of Oracle, is a comprehensive ERP solution that includes robust accounting features for large businesses. It’s a powerful tool that provides real-time financial reporting, automated billing, and integrated CRM functionalities. NetSuite is ideal for companies looking for an all-in-one solution that can manage complex financial operations across multiple departments.

Reviews:

NetSuite is highly regarded by enterprise-level businesses for its extensive features, scalability, and integration capabilities. However, some users mention that it can be difficult to implement and requires dedicated personnel to manage its complexity.

Key Features:

- General ledger and financial management

- Accounts payable and receivable

- Real-time financial reporting

- Multi-currency and multi-tax support

- Integrated customer relationship management (CRM)

Pros:

- Highly customizable

- Excellent for large, complex businesses

- Full-suite ERP solution

Cons:

- Expensive for small businesses

- Requires time and expertise to set up

Ideal For: Large enterprises needing a comprehensive ERP system with powerful financial management features.

11. Crunch Accounting – Best for Simple and Affordable Bookkeeping

Crunch Accounting is designed specifically for freelancers, contractors, and small businesses. It offers straightforward bookkeeping, tax reporting, and invoicing features. Crunch’s affordable pricing model makes it a great choice for small businesses looking for a no-fuss accounting solution without compromising essential features.

Reviews:

Users love Crunch for its simplicity and affordability. The software is particularly useful for freelancers and contractors who need to stay on top of taxes and expenses. However, some users feel that the customer support could be improved.

Key Features:

- Invoicing and expense tracking

- Self-assessment tax returns

- Real-time reporting

- Integrated payroll

- Support for UK tax codes

Pros:

- Affordable pricing

- Simple and easy to use

- Strong support for freelancers and contractors

Cons:

- Limited features for larger businesses

- Customer support can be slow at times

Ideal For: Freelancers and small businesses looking for affordable and simple accounting tools.

12. Bill – Best for Expense Management and Budget Control

Bill is an expense management and budgeting software designed to help businesses gain real-time visibility into spending and maintain control over their budgets. It combines physical and virtual corporate cards with expense tracking tools, making it ideal for businesses seeking to streamline their expense workflows.

Reviews:

Bill is widely praised for its intuitive interface and automation of expense reporting. Users appreciate the ability to set spending limits and manage employee expenses in real time. Some users, however, note that its accounting integrations may require customization depending on the software used.

Key Features:

- Real-time expense tracking

- Corporate card issuance (physical and virtual)

- Budget creation and monitoring

- Automated expense reports

- Integrations with major accounting software

Pros:

- Excellent for managing employee spending

- Real-time budget visibility and control

- Free to use with no upfront cost

Cons:

- Limited features for full-scale accounting

- Some integration limitations with less common accounting tools

Ideal For: Businesses of all sizes that need robust expense tracking and budget control without the complexity of full accounting software.

13. Reach – Best for Integrated Accounting and Business Management

Reach is an integrated accounting and business management software that focuses on providing small to medium-sized businesses with everything they need in one solution. It offers financial management, project tracking, and client management, making it suitable for businesses that require more than just basic accounting.

Reviews:

Reach is appreciated for its all-in-one approach, where users can manage both accounting and project tracking within the same platform. However, it may not be as deep in accounting features as some other dedicated accounting tools.

Key Features:

- Financial reporting and invoicing

- Project management tools

- Client management

- Time tracking for projects

- Integrated document storage

Pros:

- All-in-one solution for managing projects and finances

- Easy-to-use interface

- Affordable for small businesses

Cons:

- Lacks advanced accounting features

- Not ideal for larger organizations with complex accounting needs

Ideal For: Small to medium-sized businesses that need integrated accounting and project management.

14. ORION ERP – Best for ERP Systems with Accounting Functionalities

ORION ERP is an integrated enterprise resource planning solution with built-in accounting functionalities. It provides end-to-end business management tools, from procurement to sales, including advanced financial management capabilities. It’s ideal for businesses that require a comprehensive system that integrates various business processes.

Reviews:

ORION ERP is highly regarded for its integrated approach and its ability to manage different business operations in one place. However, some users find its implementation time and complexity to be challenging.

Key Features:

- Financial accounting and reporting

- Inventory and procurement management

- Sales and customer relationship management (CRM)

- Multi-currency support

- Real-time business insights

Pros:

- Comprehensive ERP solution

- Great for businesses with diverse needs

- Strong financial management tools

Cons:

- Complex and time-consuming to set up

- Not suitable for small businesses with simpler needs

Ideal For: Medium to large businesses looking for an integrated ERP system with accounting functionalities.

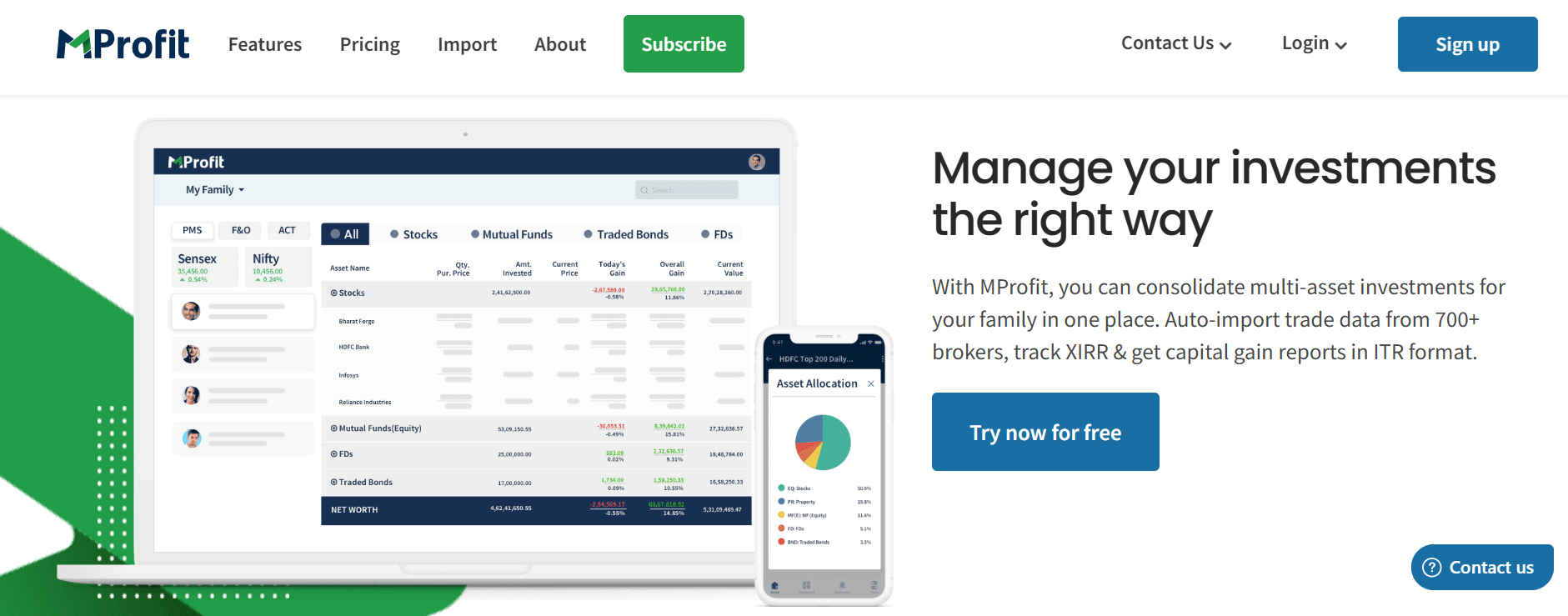

15. MProfit for Accounting – Best for Investment and Portfolio Accounting

MProfit is a specialized accounting software designed for managing investments and portfolios. It is ideal for individual investors, financial advisors, and businesses that need to track their investment portfolios, calculate capital gains, and manage tax reports.

Reviews:

MProfit is praised for its investment-specific features, which make it ideal for managing portfolios and investment accounting. Users appreciate its ability to generate capital gains reports and manage multiple accounts in one place.

Key Features:

- Investment portfolio tracking

- Capital gains tax calculations

- Real-time performance reports

- Integration with bank accounts and brokers

- Multi-asset class support

Pros:

- Specialized for investment tracking

- Accurate tax calculations

- User-friendly interface

Cons:

- Limited to investment-focused accounting

- Not suitable for businesses needing full accounting features

Ideal For: Investors and businesses managing investment portfolios.

Frequently Asked Questions (FAQs)

How do I know which accounting software is best for my business?

When choosing accounting software, consider your business size, industry, and specific needs. For small businesses, Sage Accounting or Crunch Accounting may be ideal. Larger enterprises might benefit from Oracle NetSuite or SAP for advanced functionalities.

Do I need a specialized accounting tool for tax purposes?

If tax management is a primary concern, consider software like TaxCycle or FreshBooks, which offer in-depth tax filing and VAT management tools tailored to the UK market.

How much should I expect to pay for accounting software?

Pricing varies depending on the software and business size. Basic software like Crunch Accounting may cost around £10–£20 per month, while enterprise-level solutions like NetSuite or SAP can run into the thousands per year. Many software providers offer free trials, so it’s worth testing out a few options.

What features should I look for in accounting software?

Look for software that offers easy invoicing, tax calculations, financial reporting, and bank reconciliation. Additionally, integration with your other tools and multi-user access are valuable features for growing businesses.