UK Accounts Payable Software:

In today’s automated finance landscape, choosing the right accounts payable software in the UK is critical for operational efficiency, tax compliance, and cost control. Whether managing a small business or scaling an enterprise, the best AP platform ensures automated invoice entry, real-time approvals, HMRC-recognized VAT filing, and seamless payment workflows. But with so many tools offering OCR, MTD support, and ERP integrations how do you select the most effective one?

As part of our ongoing evaluation of UK financial automation tools, we’ve analyzed and compared the leading accounts payable software platforms available in 2025. This year’s list ranks the top performers based on invoice automation depth, Making Tax Digital readiness, UK bank integrations, user experience, and cross-system compatibility.

Here are the Best Accounts Payable Software’s in the UK right now:

- Xero – Best for small businesses with UK tax needs. Offers automated invoice entry, recurring bills, bank syncing, and full MTD compliance.

- QuickBooks Online – Best for SMEs needing simple AP. Supports scheduled payments, expense tracking, VAT returns, and links with UK banks.

- Sage Intacct – Best for mid-to-large enterprises. Enables multi-entity AP, approval workflows, and compliance with UK GAAP and IFRS standards.

- Tipalti – Best for global AP automation. Manages cross-border vendor payments, tax forms, and currency conversions for large finance teams.

- AccountsIQ – Best for multi-entity accounting. Offers invoice scanning, consolidated reporting, and integration with UK-based ERP tools.

Want to cut costs, boost speed, and stay compliant? Explore the full breakdown of the UK’s leading AP software and see which one fits your business best.

Top 15 Best Accounts Payable Software in UK:

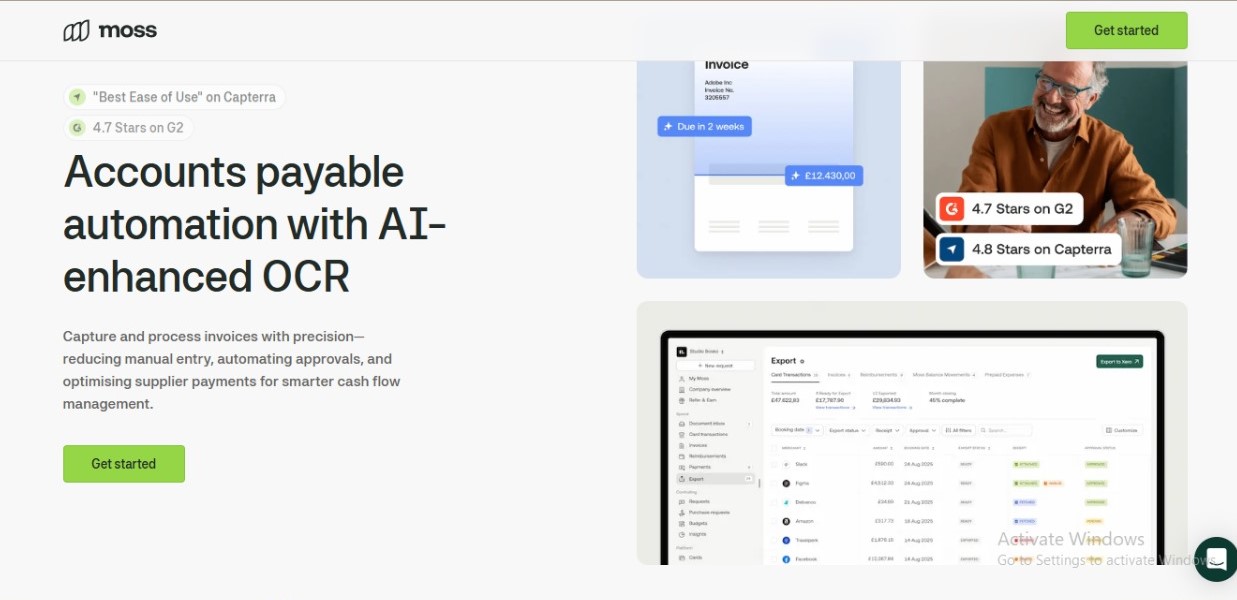

- Moss– Best for spend management platform streamlining company expenses and corporate cards

- Tipalti – Best for global payables automation and mass payouts

- Precoro – Best for cloud-based procurement software simplifying purchasing

- Payhawk– Best for all-in-one spend management solution for payments

- Pleo – Best for smart expense management platform offering company cards

- FreshBooks – Best for accounting software designed for small businesses and freelancers.

- SAP Concur Invoice – Best for large teams with complex approval flows

- Lightyear – Best for real-time invoice capture and PO matching

- Quadient AP (Beanworks) – Best for cloud AP workflows and mobile approvals

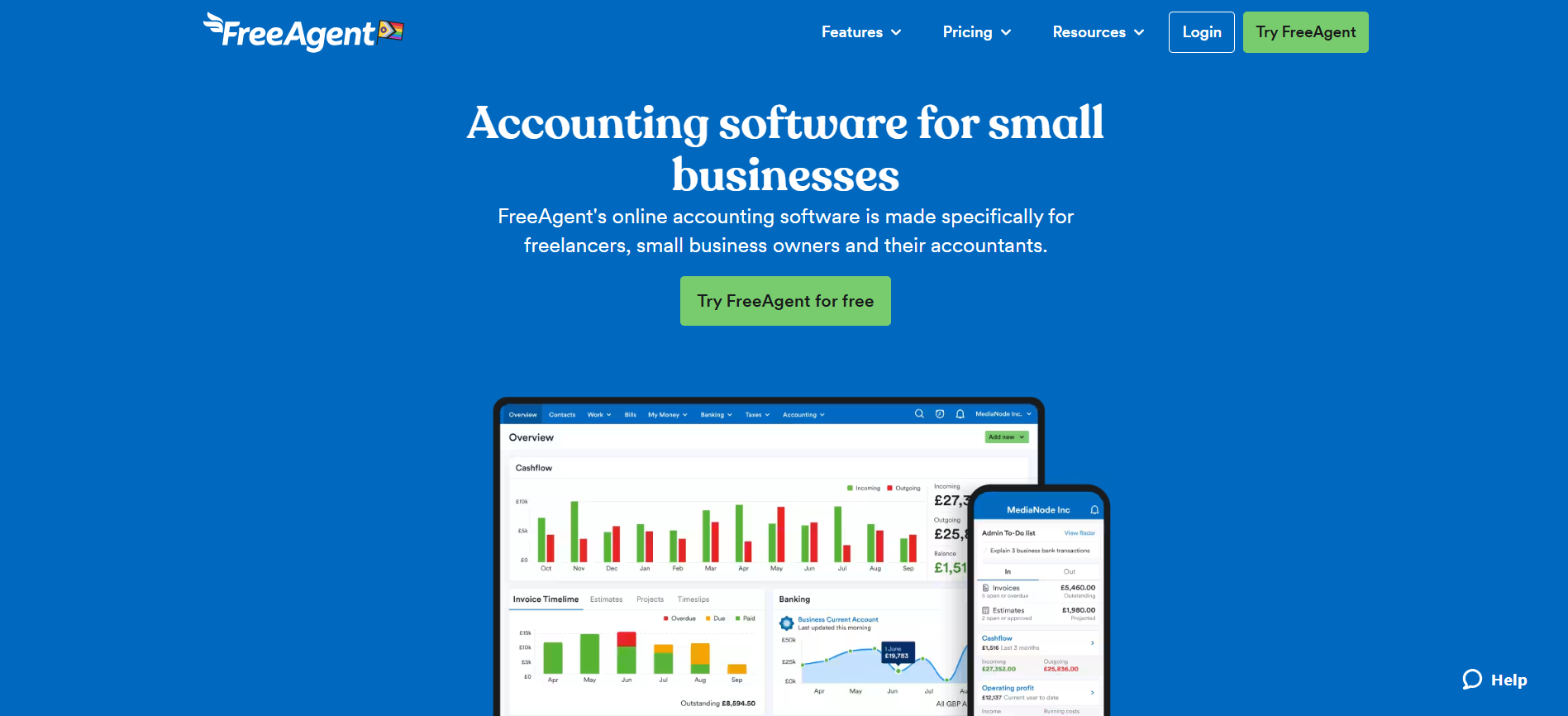

- FreeAgent – Best for contractors and sole traders in the UK

- Kefron AP – Best for AI-driven invoice digitization and storage

- Compleat – Best for budget control and finance team visibility

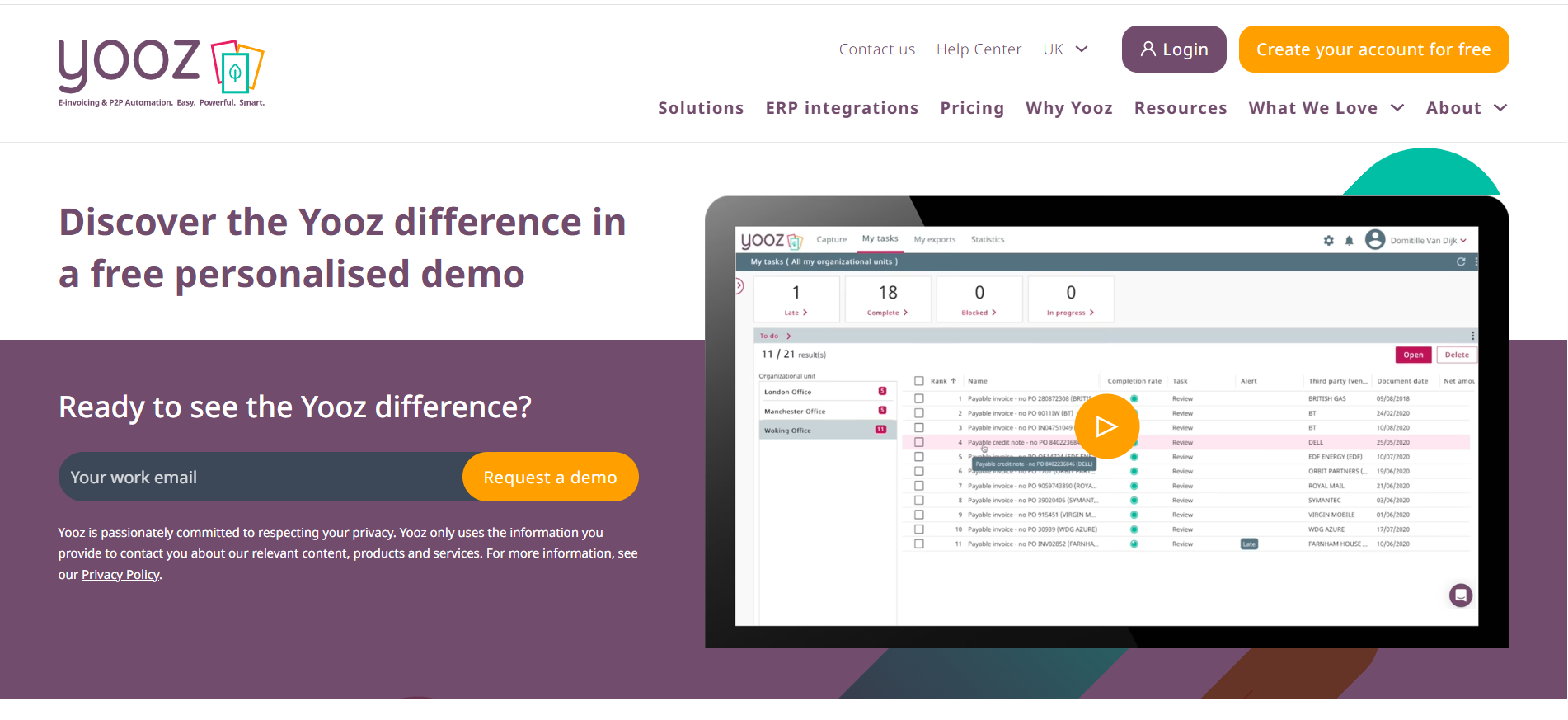

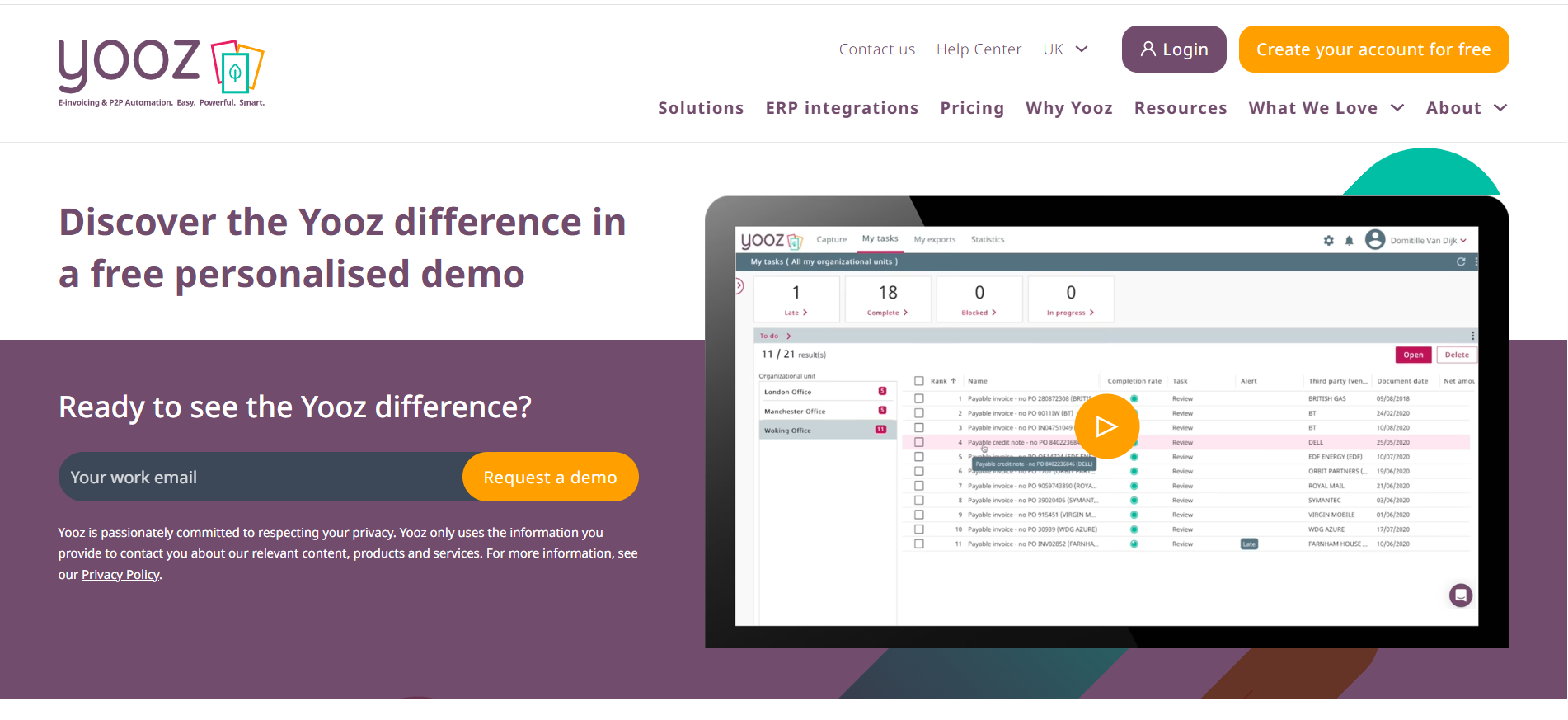

- Yooz – Best for AI-powered AP automation and fraud detection

- Telleroo – Best for bulk UK payments via Faster Payments integration

Before You Continue…

Choose accounts payable software with built-in communication tools. HubSpot CEO Brian Halligan states, “Good communication is the bridge between confusion and clarity.” AP systems with integrated messaging streamline invoice queries, vendor coordination, and internal approvals. Ensure invoice processing tools support real-time collaboration. Clear communication reduces delays, errors, and duplicate payments. Spend time evaluating platforms with in-app chat, email tracking, and role-based comment features. Absorb the benefits of automated workflows combined with audit-friendly communication logs. Optimize team efficiency by choosing AP software that aligns communication with transaction actions.

Question to Ask When Choosing the Best Accounts Payable Software in the UK

- Does the software support Making Tax Digital (MTD) for VAT submissions to HMRC?

- Does it automate invoice capture, approval workflows, and batch payments?

- Does it integrate directly with major UK banks for real-time payments and reconciliation?

- Does the tool support UK-based audit trails, fraud detection, and vendor compliance?

- Can it manage multiple UK business entities, currencies, and supplier tax profiles accurately?

How This Top 15 List Was Created

The Top 15 list was created using entity-focused research from UK-based accounting, finance, and enterprise software directories. Sources include Capterra UK, Trustpilot, Companies House, and vendor documentation. Tools were selected based on market adoption, UK regulatory compliance, and AP functionality. Attributes such as OCR scanning, VAT support, multi-currency processing, and automation scope were prioritized. Selection also considered native UK support, Making Tax Digital (MTD) readiness, and integration with HMRC-approved systems. Platforms with scalable features, secure payment processing, and supplier collaboration tools were included. Public product documentation and verified user case studies were used to validate performance.

1. Moss – Best for UK Teams Seeking Flexible Spend Control & Automation

Moss empowers UK companies to simplify spend management by offering smart corporate cards, automated invoice handling, and real-time budget tracking. Designed for finance teams, Moss streamlines workflows with customizable policies and seamless integrations.

Reviews

Finance professionals across mid-sized to large UK firms appreciate Moss for its intuitive interface and efficient budget controls. It’s often praised for reducing manual tasks, while some users note that card issuance policies may require initial setup time for scaling teams.

Features of Moss

- Issue unlimited virtual & physical cards with limits

- Automate invoice capture, approvals, and categorisation

- Real-time budget tracking and spend insights

- Customisable approval workflows for team-level control

- Reimbursements with automated compliance checks

- Direct integrations with accounting tools like Xero and DATEV

- Multi-entity and multi-currency support for UK/global teams

Final Verdict

Moss is ideal for growing UK teams and enterprises seeking smarter, scalable control over expenses, budgets, and payments.

Pros of Moss

- Fast setup with intuitive UI

- Flexible card issuance and expense control

- Real-time budget visibility

- Seamless accounting integration

- Ideal for distributed or hybrid teams

Cons of Moss

- Limited custom reporting for complex audit needs

- Setup effort required for policy-based controls

2. Tipalti – Best for global payables automation and mass payouts

Tipalti automates global AP for companies handling cross-border transactions. It handles supplier onboarding, tax compliance, FX conversion, and payment scheduling in 190+ countries. UK finance teams use it to unify multi-currency payables with audit-ready records.

Reviews

Users praise Tipalti for automating complex international workflows. Enterprises value its built-in tax form collection, compliance controls, and fraud detection. Some report a steeper implementation phase.

Features of Tipalti

-

Process mass global vendor payments

-

Auto-collect W-8/W-9 and VAT forms

-

Convert payments in multiple currencies

-

Automate AP workflows with approvals

-

Detect duplicate invoices and fraud

-

Integrate with ERP and accounting platforms

-

Generate audit-ready payment trails

Final Verdict

Tipalti is suited for UK firms managing high-volume or global supplier payments with compliance at scale.

Pros of Tipalti

-

Cross-border AP automation

-

FX management and multi-currency support

-

Built-in tax compliance tools

-

End-to-end payment traceability

-

Reduces manual workload significantly

Cons

3. Precoro – Best for UK Teams Needing Streamlined Procurement & Approval Flows

Precoro helps UK businesses simplify and automate procurement processes with built-in purchase order management, approvals, and budget tracking. It’s designed for teams that want better visibility and control over company spending without complex systems.

Reviews

UK finance and operations teams appreciate Precoro for its ease of use and customizable workflows. It’s often chosen for PO automation and expense transparency. Some users mention the lack of advanced reporting for enterprise-level analysis.

Features of Precoro

- Create and manage purchase requests and POs easily

- Automate approval workflows for each department

- Track budgets and spending in real time

- Manage suppliers and catalogs centrally

- Generate customizable reports and audit logs

- Integrate with tools like QuickBooks, Xero, and NetSuite

- Multi-location and multi-currency support

Final Verdict

Precoro is best for UK teams looking to digitise procurement, improve spend oversight, and reduce manual paperwork.

Pros of Precoro

- User-friendly interface with fast onboarding

- End-to-end purchase-to-pay process

- Real-time budget tracking

- Strong supplier and item catalog management

- Scalable for growing teams

Cons of Precoro

- Lacks deep analytics for complex enterprise needs

- Limited mobile functionality compared to some competitors

4. Payhawk – Best for UK Companies Seeking Unified Spend, Expense & Invoice Control

Payhawk offers an all-in-one solution for managing company expenses, invoices, and payments with built-in corporate cards. Tailored for finance teams, Payhawk helps UK businesses streamline workflows, eliminate manual work, and gain full control over company spend.

Reviews

Finance leaders in the UK value Payhawk for its end-to-end spend visibility and automation. It’s praised for strong integrations and international support. Some mention the need for more advanced customization in reporting and workflows for niche industries.

Features of Payhawk

- Issue corporate Visa cards with spend limits

- Automate expense claims and approvals

- Capture invoices and match them to POs

- Real-time tracking of company-wide spend

- Reimburse employees directly from the platform

- Integrate with accounting systems like Xero, NetSuite, and SAP

- Multi-entity, multi-currency support for global teams

Final Verdict

Payhawk is ideal for modern UK businesses looking to centralize expense management, automate approvals, and ensure financial compliance.

Pros of Payhawk

- Complete spend visibility from a single platform

- Strong integration with ERP and accounting tools

- Fast, automated invoice and expense processing

- Global support for multi-currency companies

- Mobile app for on-the-go expense capture

Cons of Payhawk

- Reporting features may require enhancement for advanced users

- Initial setup can be time-consuming for large-scale teams

5. Pleo – Best for SMEs Needing Smart Expense Automation with Prepaid Cards

Pleo offers modern expense management tools for UK SMEs, combining smart company cards with real-time spend tracking, automated receipt capture, and seamless accounting integrations. It simplifies approvals and expense categorization while ensuring control and visibility across all transactions.

Reviews

UK teams value Pleo for its intuitive card system and automated receipt handling. It’s praised for saving time on manual reimbursements and improving policy enforcement. Some users mention the need for deeper analytics and reporting features for complex finance operations.

Features of Pleo

- Issue prepaid virtual and physical cards to employees

- Automate expense categorization with AI

- Capture receipts via mobile app or email forwarding

- Set spending limits and approval flows

- Sync transactions with accounting software like Xero, QuickBooks, and Sage

- Track spending in real time by team or project

- Export reports for finance and tax compliance

Final Verdict

Pleo is perfect for small to mid-sized UK companies looking to automate expense reporting and gain control over team spending.

Pros of Pleo

- Smart company cards for simplified spend tracking

- Automated receipt matching and categorization

- Seamless integration with UK accounting tools

- Real-time dashboards and budget controls

- Great mobile experience for users on the go

Cons of Pleo

- Reporting features may be limited for large finance teams

- No native support for vendor bill or AP automation

6. Fresh Books – Best for freelancers and startups with MTD support

Fresh Books offers affordable AP features for UK freelancers and micro-businesses. It supports vendor billing, bank feeds, expense automation, and MTD-compliant VAT filing. It also includes AI-powered categorization and mobile invoicing.

Reviews

Users appreciate Fresh Books for its simplicity, cost-efficiency, and HMRC compatibility. Freelancers highlight the built-in VAT tools and expense tracking. Some users feel integrations are limited compared to larger platforms.

Features of Fresh Books

-

Create and manage vendor bills

-

Automate recurring AP entries

-

Connect and reconcile UK bank accounts

-

File MTD VAT returns with HMRC

-

Digitize receipts using mobile scanning

-

Track payables and generate reminders

-

Access reports for cash flow and due bills

Final Verdict

Fresh Books is ideal for small UK firms wanting low-cost AP with full tax compliance.

Pros of Fresh Books

Cons of Frssh Books

7. SAP Concur Invoice – Best for large teams with complex approval flows

SAP Concur Invoice enables large UK companies to manage complex AP processes. It automates invoice capture, matching, and approvals while offering full policy controls and analytics.

Reviews

Enterprises rate SAP Concur highly for scale, governance, and control. It’s often used by finance leaders for policy enforcement and workflow visibility. Some mention a steeper learning curve and pricing concerns.

Features of SAP Concur Invoice

-

Digitally capture and approve invoices

-

Enforce policies with custom approval paths

-

Match invoices with POs and goods receipts

-

Track audit logs and spending by cost centre

-

Automate duplicate invoice detection

-

Connect to ERP systems like SAP and Oracle

-

Access analytics dashboards and compliance tools

Final Verdict

SAP Concur Invoice is best for UK enterprises needing policy-driven AP automation.

Pros of SAP Concur Invoice

-

Advanced approval configuration

-

Scalable enterprise-grade features

-

ERP integration and analytics

-

Full compliance audit trail

-

Suitable for high-volume AP

Cons of SAP Concur Invoice

8. Lightyear – Best for real-time invoice capture and PO matching

Lightyear automates AP for UK finance teams with OCR invoice capture, real-time approvals, and PO matching. It integrates with Xero, QuickBooks, and NetSuite.

Reviews

Users value Lightyear for invoice accuracy, quick approvals, and audit readiness. It’s praised by finance teams with heavy purchase orders and supplier volume. Some request expanded reporting options.

Features of Lightyear

-

Scan and extract invoice data via OCR

-

Match invoices with POs and delivery notes

-

Customize multi-step approval flows

-

Store invoice documents in the cloud

-

Export to accounting tools and ERPs

-

Gain real-time insights and exception alerts

Final Verdict

Lightyear is suited for UK SMEs needing accurate invoice scanning and fast PO validation.

Pros of Lightyear

-

OCR-based invoice capture

-

Real-time PO/invoice matching

-

Scalable approval workflows

-

Integrates with major UK accounting apps

-

Secure digital document storage

Cons of Lightyear

9. Quadient AP (formerly Beanworks) – Best for cloud AP workflows and mobile approvals

Quadient AP enables UK teams to fully digitize accounts payable processes in the cloud. It supports invoice automation, mobile approvals, and PO-based workflows.

Reviews

UK businesses like the mobile approval capability and role-based controls. Users highlight faster processing and fewer manual errors. Some note longer integration time with legacy systems.

Features of Quadient AP

-

Automate AP workflows from capture to payment

-

Use mobile approvals and notifications

-

Match invoices to POs and receipts

-

Track approval status in real time

-

Integrate with Sage, Xero, and QuickBooks

-

Audit-ready logs and spend visibility

Final Verdict

Quadient AP is ideal for UK finance teams that need remote AP controls and cloud flexibility.

Pros of Quadient AP

-

Fully cloud-based AP system

-

Mobile invoice approvals

-

Real-time spend tracking

-

Easy PO/invoice reconciliation

-

Secure audit log generation

Cons of Quadient AP

10. FreeAgent – Best for contractors and sole traders in the UK

FreeAgent delivers AP features for UK contractors and small traders. It includes bill tracking, expense logging, VAT returns, and automatic reminders. Fully HMRC-recognized for MTD.

Reviews

Freelancers and micro-businesses use FreeAgent for simple AP and tax filing. Users praise its invoice reminders and HMRC tools. Some say features are basic for larger teams.

Features of FreeAgent

-

Log and track vendor bills and expenses

-

Submit MTD VAT returns to HMRC

-

Link to UK bank accounts for reconciliation

-

Schedule and receive payment reminders

-

Generate bill payment history and timelines

-

Use mobile access for on-the-go entries

Final Verdict

FreeAgent is great for UK self-employed needing basic, compliant AP tools.

Pros of FreeAgent

-

MTD-ready and HMRC recognized

-

Suits sole traders and microbusinesses

-

Easy-to-use and affordable

-

Mobile access and bill reminders

-

Real-time financial snapshots

Cons of FreeAgent

11. Kefron AP – Best for AI-driven invoice digitization and storage

Kefron AP digitizes paper invoices using AI OCR, automating the capture and validation of AP documents. It enables UK finance teams to gain control and visibility over spend.

Reviews

Users trust Kefron AP for transforming manual AP into digital-first. It’s praised for scanning precision, compliance features, and bulk processing. Some seek better user navigation.

Features of Kefron AP

-

Scan and digitize paper invoices via OCR

-

Validate and match invoice data

-

Route documents through approval workflows

-

Archive and retrieve invoices in the cloud

-

Integrate with UK accounting and ERP platforms

-

Ensure document compliance and audit-readiness

Final Verdict

Kefron AP helps UK firms digitize legacy AP workflows with compliance-focused tools.

Pros of Kefron AP

-

Accurate AI-based invoice scanning

-

Secure digital invoice storage

-

Reduces paper and manual input

-

Quick access to documents

-

Supports compliance requirements

Cons of Kefron AP

12. Compleat – Best for budget control and finance team visibility

Compleat offers UK businesses spend visibility through its full AP suite. It manages invoice approvals, budget enforcement, and automated processing with ERP integrations.

Reviews

UK finance teams choose Compleat for budget controls and user-based workflows. It’s praised for invoice-to-budget visibility. Some mention the reporting dashboard could improve.

Features of Compleat

-

Automate invoice matching and validation

-

Enforce budgets during approval flows

-

View AP data linked to financial goals

-

Integrate with Sage, Xero, NetSuite

-

Custom approval chains by user role

-

Access centralized dashboard with alerts

Final Verdict

Compleat is ideal for UK companies enforcing budgets across departments.

Pros of Compleat

-

Budget visibility during invoice review

-

ERP and accounting integration

-

Configurable approval workflows

-

Spend alerts and tracking

-

Cloud-based access

Cons of Compleat

13. Yooz – Best for AI-powered AP automation and fraud detection

Yooz automates AP using AI and machine learning. It digitizes invoice processing, matches POs, and flags anomalies. UK teams gain secure, audit-friendly automation.

Reviews

Users rate Yooz for speed, fraud detection, and AI classification. It’s valued for large invoice volumes. Some request better custom reporting.

Features of Yooz

-

AI invoice capture and auto-validation

-

Real-time fraud and anomaly alerts

-

Multi-user invoice approvals

-

Full audit trails for compliance

-

ERP integration with UK accounting tools

-

Cloud storage and document search

Final Verdict

Yooz fits UK companies automating large AP loads while ensuring fraud protection.

Pros of Yooz

Cons of Yooz

14. Pleo Invoices – Best for merging expense cards and vendor payments

Pleo Invoices merges vendor payment automation with Pleo’s expense management cards. UK teams can streamline both AP and employee spend in one platform.

Reviews

Users like the unified view of AP and team spending. Businesses report better spend control and simple vendor payment scheduling. Some mention limited support for large AP loads.

Features of Pleo Invoices

-

Automate invoice uploads and approvals

-

Pay vendors via Faster Payments

-

Sync card expenses and AP workflows

-

Match invoices with budgets and team spend

-

Integrate with UK accounting software

-

Gain oversight of total spend in one view

Final Verdict

Pleo Invoices suits UK firms managing both employee and vendor spending together.

Pros of Pleo

-

Unified spend control system

-

Built-in UK payments

-

Team card and invoice sync

-

Budget alerts and spend tracking

-

Simple and modern UI

Cons of Pleo

15. Telleroo – Best for bulk UK payments via Faster Payments integration

Telleroo simplifies UK supplier payments via automated Faster Payments. It integrates with accounting tools to push payment runs securely.

Reviews

UK finance teams use Telleroo for fast, secure bank payments. It’s praised for speed, audit control, and cost savings. Some want deeper integrations.

Features of Telleroo

-

Automate supplier batch payments

-

Use Faster Payments for same-day delivery

-

Secure approval workflows for bulk runs

-

Connect with Xero, Sage, FreeAgent

-

Track payment history with audit logs

-

Reduce manual bank file uploads

Final Verdict

Telleroo is best for UK firms needing fast and scalable domestic supplier payments.

Pros of Telleroo

Cons of Telleroo

Frequently Asked Questions

Does the software support Making Tax Digital (MTD) for VAT submissions to HMRC?

Yes. HMRC-recognized AP software supports MTD-compliant VAT filings. Enable digital VAT return submissions using HMRC APIs. Ensure VAT records are stored and submitted in digital form.

Support automated VAT calculations based on live invoice data.

Does it automate invoice capture, approval workflows, and batch payments?

Yes. AP software automates invoice capture with OCR and AI tools. Trigger multi-level approval workflows based on rules or roles. Enable batch payment scheduling and bulk processing.

Reduce processing time by syncing invoices to payment runs.

Does it integrate directly with major UK banks for real-time payments and reconciliation?

Yes. Leading platforms integrate with Barclays, HSBC, Lloyds, NatWest. Support open banking feeds for real-time data and reconciliations. Push payments directly from system to bank via secure APIs.

Enable automatic matching of paid transactions against invoices.

Does the tool support UK-based audit trails, fraud detection, and vendor compliance?

Yes. Systems log all user actions with timestamped audit trails. Support fraud detection with duplicate invoice flags and access controls. Maintain supplier compliance through verified tax IDs and KYC data.

Provide audit-ready reports aligned with UK financial regulations.

Can it manage multiple UK business entities, currencies, and supplier tax profiles accurately?

Yes. Multi-entity support allows centralized control across UK units. Enable accurate handling of GBP, EUR, and other currencies. Assign unique tax rules and VAT profiles per supplier. Generate consolidated or entity-specific AP reports with full accuracy.