In 2025, startups depend on reliable, easy-to-use billing software to stay on top of invoices, payments, and cash flow. With many businesses now serving global customers, fast and seamless digital transactions are no longer optional they’re expected. The latest billing tools help automate invoicing, manage recurring payments, and track payments in real-time, saving teams valuable time and reducing errors. In this guide, we’ve rounded up the most popular billing software for startups in 2025, with a clear breakdown of features, pros, cons, and which type of business each tool is best suited for.

Here are the Best billing Software’s right now:

- QuickBooks Online – Popular all-in-one billing and accounting solution with automated invoicing. It supports expense tracking, payment reminders, and bank integrations. Ideal for small to medium-sized businesses needing full financial control.

- FreshBooks – Best for freelancers and small teams needing easy invoicing and payment tracking. Includes time tracking, expense management, and client payment options. Its user-friendly interface simplifies billing for service-based businesses.

- Zoho Invoice – Free cloud-based invoicing with multi-currency support and automation tools. It offers customizable invoice templates, payment reminders, and expense tracking. Suitable for small businesses working with global clients.

- Wave – Fully free invoicing and billing platform with online payment options for small businesses. Includes unlimited invoices, recurring billing, and receipt scanning. A cost-effective solution for startups and sole traders.

- Invoice2go – Mobile-first billing and invoicing solution ideal for entrepreneurs on the go. Provides customizable invoices, expense tracking, and real-time payment updates. Perfect for freelancers and small business owners needing flexibility.

Top 10 Billing Software for Startups (2025)

- QuickBooks Online – Popular all-in-one billing and accounting solution with automated invoicing.

- FreshBooks – Best for freelancers and small teams needing easy invoicing and payment tracking.

- Zoho Invoice – Free cloud-based invoicing with multi-currency support and automation tools.

- Wave – Fully free invoicing and billing platform with online payment options for small businesses.

- Invoice2go – Mobile-first billing and invoicing solution ideal for entrepreneurs on the go.

- Square Invoices – Simple, pay-per-transaction billing with integrated payment processing.

- Xero – Comprehensive billing and accounting platform with excellent scalability for startups.

- PayPal Invoicing – Easy-to-use, free invoicing tool with seamless PayPal payment collection.

- Bill.com – Automates accounts payable and receivable for growing businesses.

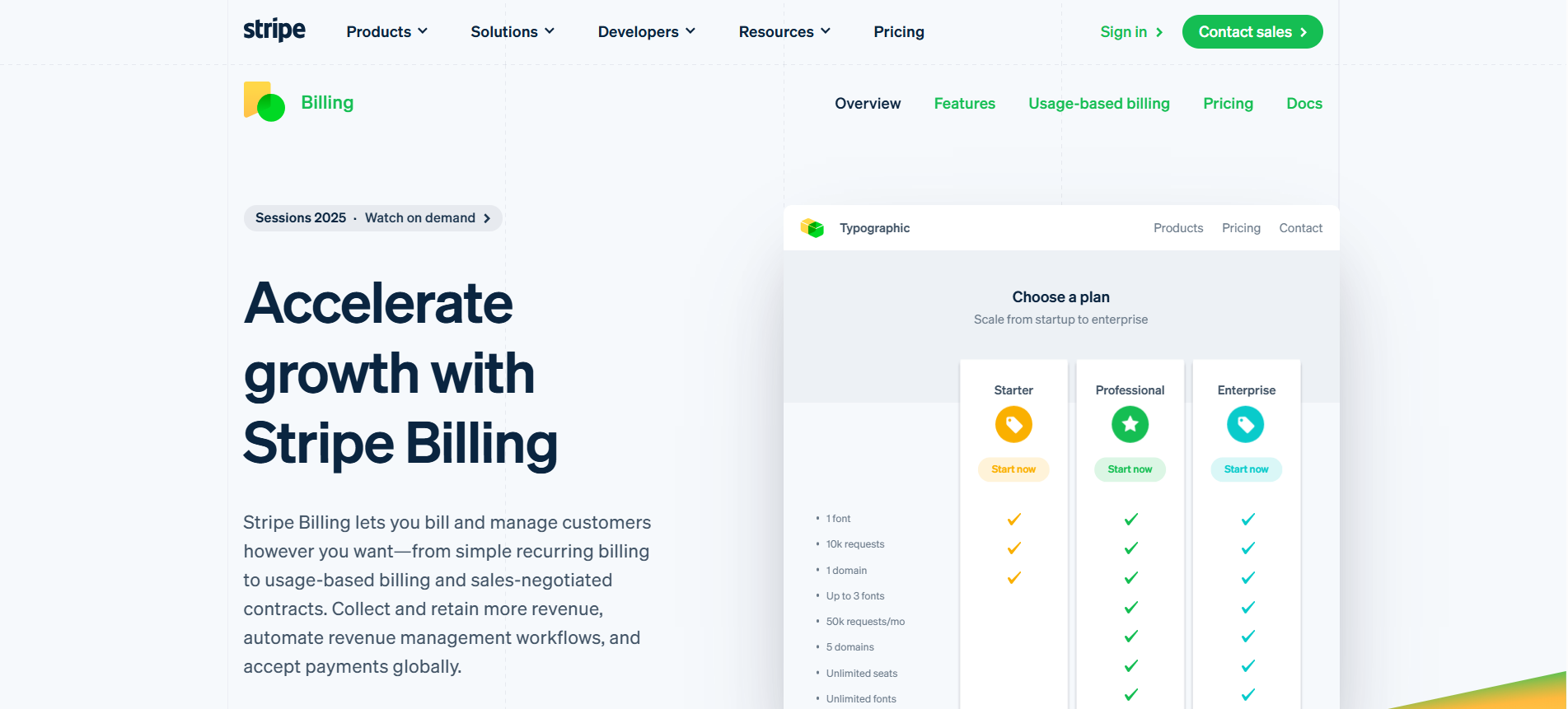

- Stripe Billing – Developer-friendly billing solution for SaaS, subscription, and usage-based pricing models.

Before You Continue…

Billing software automates invoicing, tracks payments, and improves financial accuracy across businesses. Verified research from Gartner confirms billing systems reduce manual errors, speed up payment cycles, and centralize revenue tracking. These tools generate professional invoices, apply taxes, manage recurring billing, and support multiple payment methods. Billing software also integrates with accounting platforms to ensure accurate financial records and real-time reporting. Businesses using billing solutions improve cash flow management, enhance client communication, and reduce administrative workload.

Question to Ask When Choosing the Best Billing Software

- Does the software support automated invoicing and recurring payments?

- Can it handle multi-currency and global tax compliance?

- Is it easy to integrate with my existing accounting or CRM tools?

- Does it offer scalable plans for future business growth?

- What security measures and data protection features are included?

How This Top 10 List Was Created

This Top 10 billing software list was created through detailed market research and feature comparison. Popular platforms were shortlisted based on real user feedback, pricing transparency, and essential billing features like invoicing, payment tracking, and automation. Industry relevance and global usability were also considered to ensure every tool on the list meets the practical needs of businesses today.

Pricing Breakdown by Business Type for Billing Software

Billing Software for Startups and Small Teams

For freelancers, startups, and small businesses, keeping things simple and affordable matters most. These teams usually just need the basics easy invoicing, payment tracking, and simple expense management without getting lost in complicated features.

Popular tools like Wave, Zoho Invoice, and Square Invoices offer exactly that. They provide unlimited invoices, payment reminders, and mobile access, all with minimal setup and no long-term commitments. It’s an easy, budget-friendly way to manage billing from day one.

Billing Solutions for Growing Businesses

As your business grows, so do your billing needs. Manual processes won’t cut it anymore. You need tools that help you stay organized like recurring billing, automated reminders, multi-user access, and smooth integration with your accounting software or CRM.

Platforms like FreshBooks, QuickBooks Online, Xero, and Invoice2go are built for growing teams. They make it easy to track project billing, log hours, send invoices in different currencies, and customize invoice templates all while keeping your billing process running smoothly.

Enterprise-Grade Billing Software

For large businesses and enterprises, billing gets complex fast. You need tools that can scale with you, keep your data secure, and handle things like global tax rules and detailed financial reports.

Solutions like Bill.com, Stripe Billing, and Zoho Billing (Enterprise plans) help with exactly that. They offer automated workflows, advanced reporting, global payment support, and enterprise-grade security features to help big teams stay on top of complex billing processes without missing a step.

#1. QuickBooks Online – Best for Complete Invoicing and Accounting Integration

QuickBooks Online is a cloud-based billing and accounting solution built for startups and SMEs. It simplifies financial management through automated invoicing, expense tracking, recurring billing, and real-time reporting. With deep integrations to over 650 apps, bank connectivity, and mobile access, it supports tax compliance and helps streamline billing workflows. QuickBooks Online provides a comprehensive platform to manage invoicing, track payments, and maintain accurate financial records at scale.

QuickBooks Online is a cloud-based billing and accounting solution built for startups and SMEs. It simplifies financial management through automated invoicing, expense tracking, recurring billing, and real-time reporting. With deep integrations to over 650 apps, bank connectivity, and mobile access, it supports tax compliance and helps streamline billing workflows. QuickBooks Online provides a comprehensive platform to manage invoicing, track payments, and maintain accurate financial records at scale.

Reviews

QuickBooks Online is praised for its all-in-one functionality and easy integration with banks and payment processors. Some users mention higher costs for advanced features.

Features of QuickBooks Online

- Customizable invoices and recurring billing

- Payment reminders and tracking

- Bank and payment gateway integrations

- Mobile and web access

- Financial reports and expense tracking

Final Verdict

QuickBooks Online is ideal for startups needing a scalable, integrated billing and accounting platform.

Pros of QuickBooks Online

- Comprehensive billing and accounting

- Strong payment tracking

- Extensive app integrations

Cons of QuickBooks Online

- Pricing increases with advanced features

- Learning curve for new users

#2. FreshBooks – Best for User-Friendly Invoicing with Time Tracking

FreshBooks is a cloud-based billing and accounting platform designed for freelancers, service providers, and small teams. It offers user-friendly invoicing, automated payment reminders, time tracking, and expense management. With mobile accessibility and client payment portals, FreshBooks simplifies billing workflows and helps businesses manage cash flow efficiently.

FreshBooks is a cloud-based billing and accounting platform designed for freelancers, service providers, and small teams. It offers user-friendly invoicing, automated payment reminders, time tracking, and expense management. With mobile accessibility and client payment portals, FreshBooks simplifies billing workflows and helps businesses manage cash flow efficiently.

Reviews

Users value FreshBooks for its intuitive design and integrated time tracking. Some note limited scalability for larger teams.

Features of FreshBooks

- Professional invoice templates

- Time tracking and billable hours

- Online payment options

- Expense management

- Mobile app access

Final Verdict

FreshBooks is ideal for freelancers or service-based startups managing invoices and time tracking.

Pros of FreshBooks

- Simple, clean interface

- Integrated time tracking

- Easy online payments

Cons of FreshBooks

- Limited features for larger businesses

- Higher cost for advanced plans

#3. Zoho Invoice – Best for Startups Seeking a Free Invoicing Tool

Zoho Invoice is part of Zoho Corporation’s suite of business tools, offering a free, cloud-based invoicing platform tailored for small businesses. It includes features like multi-currency invoicing, recurring billing, automated payment reminders, and time tracking. Seamless integration with Zoho’s broader ecosystem makes it ideal for startups with global clients and lean finance teams.

Reviews

Startups appreciate Zoho Invoice’s free offering and flexibility. Some note limited advanced features.

Features of Zoho Invoice

- Unlimited invoices (Free plan)

- Time tracking and expense management

- Payment reminders and recurring billing

- Multi-currency support

- Integrates with other Zoho apps

Final Verdict

Zoho Invoice is a strong choice for startups needing professional invoicing with no upfront costs.

Pros of Zoho Invoice

- Generous free plan

- Simple setup and interface

- Integrates with Zoho ecosystem

Cons of Zoho Invoice

- Limited features for scaling

- Some integrations only in paid plans

#4. Wave – Best for Completely Free Invoicing and Payment Processing

Wave, a subsidiary of H&R Block, provides free billing and accounting software for freelancers and micro-businesses. The platform includes unlimited invoicing, online payment processing, receipt scanning, and basic financial reporting. Wave stands out for offering core billing features with zero subscription costs, making it accessible for bootstrapped startups.

Reviews

Wave earns praise for offering invoicing and basic accounting for free. Users note fees apply for payment processing.

Features of Wave

- Unlimited free invoicing

- Customizable templates

- Online payment processing

- Basic accounting tools

- Mobile access

Final Verdict

Wave is ideal for startups wanting essential invoicing and payment tools without subscription costs.

Pros of Wave

- Completely free invoicing

- Clean, user-friendly design

- Includes basic accounting tools

Cons of Wave

- Payment processing fees apply

- Limited advanced features

#5. Invoice2go – Best for On-the-Go Invoicing and Payments

Invoice2go is a mobile-first invoicing solution built for freelancers and entrepreneurs who manage business on the go. It supports customizable invoice templates, real-time payment tracking, and expense recording. With iOS and Android apps, Invoice2go empowers users to create professional invoices and track payments anytime, anywhere.

Reviews

Users like Invoice2go’s mobile convenience and professional invoice templates. Some find pricing higher compared to alternatives.

Features

- Mobile-first invoicing

- Payment tracking and reminders

- Expense and receipt management

- Customizable templates

- Reports and insights

Final Verdict

Invoice2go is great for startups needing mobile invoicing and easy payment tracking.

Pros

- Strong mobile functionality

- Simple invoice customization

- Integrated payment options

Cons

- Paid plans can be costly

- Limited scalability for larger teams

#6. Square Invoices – Best for Startups Already Using Square Payment Solutions

Square Invoices is part of Square’s suite of commerce tools, offering streamlined billing and payment collection for startups and small businesses. It features free invoice creation, recurring billing, and instant payment processing via Square’s ecosystem. Ideal for businesses already using Square POS, it integrates invoicing directly into sales operations.

Reviews

Startups appreciate Square’s payment speed and ease of use. Some note higher transaction fees.

Features of Square Invoices

- Free invoice creation

- Integrated with Square POS and payments

- Recurring billing and reminders

- Mobile and web access

- Payment tracking

Final Verdict

Square Invoices is ideal for startups already using Square for payments, simplifying invoicing and payment collection.

Pros of Square Invoices

- Seamless payment integration

- Fast payment processing

- Free invoice generation

Cons of Square Invoices

- Transaction fees apply

- Limited features outside Square ecosystem

#7. Xero – Best for Scalable Billing with Accounting Features

Xero is a scalable cloud accounting platform from New Zealand, built for growing businesses and accountants. It includes custom invoicing, recurring billing, real-time bank reconciliation, and financial reporting. With over 1,000 integrations and MTD compliance in the UK, Xero offers startups a comprehensive billing and accounting framework.

Reviews

Users highlight Xero’s strong reporting and accounting tools. Some find pricing higher as features expand.

Features

- Custom invoices and recurring billing

- Payment reminders and tracking

- Full accounting suite

- Multi-currency support

- 1,000+ third-party integrations

Final Verdict

Xero is ideal for growing startups needing scalable billing and integrated accounting tools.

Pros

- Robust accounting integration

- Excellent scalability

- Extensive app marketplace

Cons

- Higher price for premium plans

- Learning curve for advanced features

#8. PayPal Invoicing – Best for Simple, Global Invoicing with Trusted Payment Processing

PayPal Invoicing is a free tool from PayPal that enables businesses to send invoices and collect payments globally. It supports multi-currency billing, recurring payments, and mobile invoicing. With built-in PayPal payment processing, it’s ideal for startups needing fast, trusted, and internationally recognized billing capabilities.

Reviews

Users appreciate PayPal’s global brand recognition, fast payment collection, and ease of use. Some note higher transaction fees.

Features of PayPal Invoicing

- Simple invoice creation

- PayPal payment integration

- Recurring billing options

- Multi-currency support

- Mobile access

Final Verdict

PayPal Invoicing is ideal for startups wanting simple, trusted invoicing with global payment options.

Pros of PayPal Invoicing

- Global payment reach

- Simple, fast setup

- Mobile and desktop access

Cons of PayPal Invoicing

- Transaction fees apply

- Limited advanced invoicing features

#9. Bill.com – Best for Automating Billing and Accounts Payable

Bill.com is an enterprise-grade billing and accounts payable automation platform used by finance teams across industries. It automates invoice approvals, payment workflows, and financial reconciliation. With integrations for QuickBooks, Xero, and NetSuite, Bill.com helps startups and scaling businesses reduce manual effort and ensure financial accuracy.

Reviews

Startups appreciate Bill.com automation for payments and billing. Some note higher pricing and complexity.

Features

- Automated invoicing and payments

- Accounts payable and receivable management

- Payment reminders and tracking

- Integrations with QuickBooks, Xero, and others

- Audit-ready reports

Final Verdict

Bill.com is ideal for startups streamlining billing and automating accounts payable processes.

Pros

- Strong automation capabilities

- Reduces manual billing tasks

- Integration with major accounting tools

Cons

- Higher pricing for small teams

- Setup can be complex

#10. Stripe Billing – Best for Subscription and Usage-Based Billing

Stripe Billing is part of Stripe’s fintech infrastructure, offering a flexible solution for subscription and usage-based billing. It enables automated recurring payments, metered billing, invoicing, and global payment support. With developer-friendly APIs, Stripe Billing is ideal for SaaS startups and tech firms managing complex billing models at scale.

Reviews

Tech startups value Stripe Billing’s flexibility and developer-friendly APIs. Some note complexity for non-technical users.

Features of Stripe Billing

- Subscription and recurring billing

- Usage-based billing support

- Global payment options

- Integrations with Stripe Payments

- Developer-friendly API

Final Verdict

Stripe Billing is ideal for tech startups offering subscription services or usage-based pricing.

Pros of Stripe Billing

- Powerful subscription management

- Global payment capabilities

- Seamless Stripe Payments integration

Cons of Stripe Billing

- Complex for non-technical users

- Best suited for digital businesses

Frequently Asked Questions

Does the software support automated invoicing and recurring payments?

Yes. Most leading billing tools offer automated invoicing and recurring billing features. This ensures regular payments are sent on time without manual effort, ideal for subscription-based businesses or long-term client contracts.

Can it handle multi-currency and global tax compliance?

Reliable billing platforms like Xero or Stripe Billing support multi-currency transactions and automatic tax calculations. This helps businesses manage international clients while staying compliant with regional tax laws such as VAT or GST.

Is it easy to integrate with my existing accounting or CRM tools?

Top billing software integrates with popular platforms like QuickBooks, Zoho Books, or Salesforce. This allows you to sync client data, invoices, and payments in real-time, reducing manual data entry and errors.

Does it offer scalable plans for future business growth?

Yes. Many tools provide tiered pricing, with features designed for both small teams and large enterprises. As your business grows, you can upgrade to access advanced reporting, more users, and automation features.

What security measures and data protection features are included?

Leading billing software follows strict security standards like PCI DSS for payment processing. Features such as data encryption, role-based access, and compliance with privacy laws like GDPR are standard in enterprise-grade tools.