In today’s fast-paced digital economy, businesses in the UK need reliable, secure, and flexible payment solutions to stay competitive. Whether you’re running a brick-and-mortar shop, managing an e-commerce store, or offering services on the go, choosing the right credit card processing software can make a significant impact on your cash flow, customer experience, and business growth.

From handling chip-and-PIN and contactless payments to integrating with POS systems and online checkouts, modern processors offer a wide range of features. But with so many options on the market—each differing in transaction fees, hardware support, and integration capabilities—how do you know which one is the best fit for your business?

Should you go for low transaction fees? Easy setup? Seamless e-commerce integration? Or tools tailored to your industry?

To help you make an informed decision, we’ve analyzed and compared the most trusted credit card processing platforms in the UK. The tools on this year’s list have been selected for their reliability, feature sets, affordability, and overall user satisfaction—helping UK businesses of all sizes accept payments with ease and confidence.

Here’s a quick look at some of the best credit card processing software solutions in the UK right now:

- Square – Best all-in-one solution for small businesses. Square offers sleek POS hardware, competitive rates, and tools for both in-person and online sales.

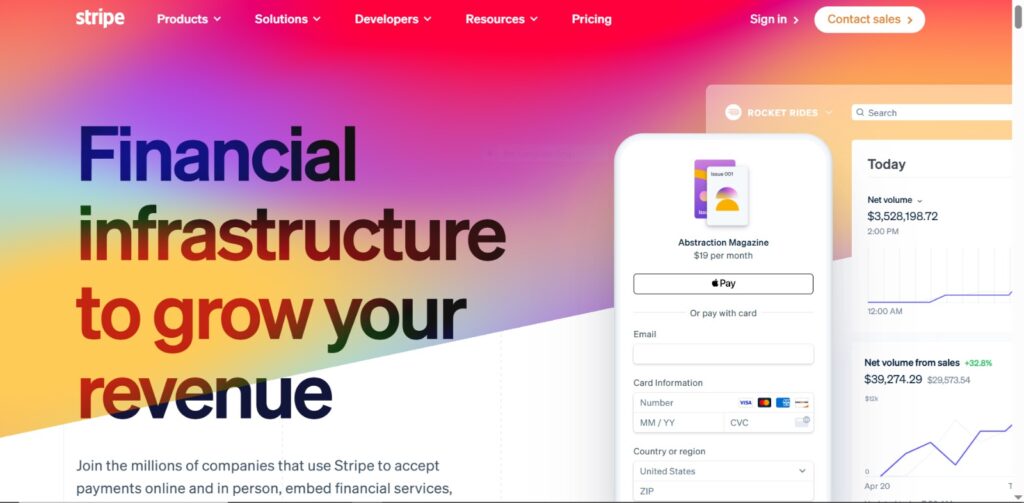

- Stripe – Best for online businesses and developers. Known for its powerful APIs, Stripe supports seamless checkout experiences and customizable payment flows.

- PayPal – Best for fast, trusted digital payments. With wide brand recognition and buyer protection, PayPal makes it easy to accept cards and other methods globally.

Want to see the full list and detailed reviews? Let’s explore which credit card processing platforms are leading the way for UK businesses in 2026.

Top 15 Best Credit Card Processing Software in UK

- Square – Best for small businesses needing an all-in-one POS and payment solution

- Stripe – Best for developers and online businesses needing customizable payment solutions

- PayPal – Best for fast, trusted online payments and global reach

- WorldPay – Best for UK-based businesses needing robust payment infrastructure

- SumUp – Best for mobile card readers and small business transactions

- iZettle – Best for point-of-sale solutions tailored to retailers and cafes

- Shopify Payments – Best for eCommerce businesses using Shopify platform

- GoCardless – Best for recurring payments and direct debit processing

- Amazon Pay – Best for eCommerce stores targeting Amazon users

- Adyen – Best for global enterprises needing multi-channel payment support

- Cybersource – Best for secure enterprise-level payment processing

- Opayo – Best for UK SMEs needing reliable payment gateway services

- Cashflows – Best for flexible and fast UK business payments

- Revolut – Best for modern businesses needing integrated financial tools and payments

- Stax – Best for subscription-based pricing and predictable payment processing costs

Before You Continue…

Choosing the right credit card processing software can make or break your business’s ability to securely and efficiently handle payments. Whether you run a small retail shop, an eCommerce store, or a service-based business, having a reliable payment system is crucial to maintaining smooth operations and offering a positive customer experience. The right solution can help streamline transactions, lower fees, and provide essential features like fraud protection, invoicing, and global payment support.

But with so many options out there, each offering different features, pricing models, and integrations, how do you make the best choice? Should you prioritize ease of use? Low transaction fees? Or maybe seamless integration with your existing software?

To help you make an informed decision, we’ve reviewed the best credit card processing software options in the UK for 2026. These platforms stand out for their reliability, competitive pricing, and overall value, helping businesses process payments quickly and securely.

Key Questions to Ask When Choosing Credit Card Processing Software:

- What are the transaction fees and hidden costs associated with the platform?

- Is the software compatible with the existing tools and systems you use?

- Does it offer support for international payments and multi-currency transactions?

- How secure is the platform in terms of PCI compliance and fraud prevention?

- Is the platform scalable and flexible to meet your future business needs?

Let’s dive into the top credit card processing solutions available in the UK!

1- Square – Best for businesses looking for an all-in-one payment solution

Square is an all-in-one payment processor that helps businesses of all sizes accept payments quickly and securely. Known for its ease of use, Square enables merchants to process payments both online and in-person without the need for complex setups. Its user-friendly interface and powerful features make it a top choice for businesses looking for simplicity and flexibility in payment processing.

Reviews

Square receives praise for its user-friendly interface and robust customer support. Small business owners appreciate the free POS system, as well as the flexibility to use Square’s payment processing both online and in-person. Customers particularly like the ability to track sales, inventory, and customer data, all from a single platform. However, some users have expressed concerns about higher transaction fees for certain payment types and international transactions.

Features of Square

With Square, you can:

- Process credit card payments in-person, online, or via mobile

- Accept contactless payments (Apple Pay, Google Pay)

- Use a free POS system with reporting and inventory management

- Set up recurring billing for subscriptions and services

- Get instant payment transfers (next-day or same-day deposits)

- Provide digital receipts and customer loyalty programs

- Access Square’s ecosystem of tools for invoicing, payroll, and eCommerce integration

Pros of Square:

- No monthly fees or hidden charges

- Free POS system with useful tools (inventory, sales tracking)

- Seamless integration with other Square tools

- Instant deposits for fast access to funds

Cons of Square:

- Higher fees for certain types of transactions (international or non-chip cards)

- Not the best option for large enterprises due to limited scalability

- Occasional delays in customer support response times

Final Verdict

Square is a reliable and cost-effective credit card processing solution, particularly ideal for small businesses or those just getting started. The combination of affordability, simplicity, and powerful tools makes it a top contender in the UK credit card processing market.

2- Stripe – Best for developers and online businesses needing customizable payment solutions

Stripe is a leading payment processor widely favored by developers and online businesses for its flexible, customizable solutions. It offers a range of advanced tools and APIs that make it easy to integrate payment processing into websites and apps. Whether you’re a startup, e-commerce business, or large enterprise, Stripe provides the scalability and versatility to handle payments, subscriptions, and invoicing with ease.

Reviews

Stripe has garnered praise for its ease of integration, extensive documentation, and strong API capabilities. Many users appreciate the platform’s ability to customize payment flows according to specific business needs. Developers particularly value Stripe’s sandbox environment, which makes testing and troubleshooting straightforward. On the downside, some users have mentioned the platform can be complex for those unfamiliar with payment APIs, and the transaction fees can be higher than some competitors, especially for international payments.

Features of Stripe

- Customizable API for integrating payments into websites and mobile apps

- Supports one-time payments, subscriptions, and invoicing

- Handles payments in over 135 currencies and various payment methods (credit cards, ACH, etc.)

- Provides advanced fraud protection and PCI compliance

- Offers a robust dashboard with analytics and reporting tools

- Includes tools for managing recurring billing, subscriptions, and payment plans

Pros of Stripe:

- Highly customizable API and integration options

- Global payment support in over 135 currencies

- Excellent fraud protection and security features

- Ideal for businesses of all sizes, from startups to large enterprises

Cons of Stripe:

- Can be complex for non-technical users

- Higher transaction fees for international payments

- Limited support for in-person transactions (compared to other platforms like Square)

Final Verdict

For businesses that need a highly flexible and developer-friendly payment solution, Stripe is an excellent choice. It offers a comprehensive set of features that can be tailored to your specific needs, ensuring smooth transactions and scalability. Its strong security and global payment support make it a reliable option for businesses looking to expand their online payment capabilities.

3- PayPal – Best for fast, trusted online payments and global reach

PayPal is one of the most well-known payment solutions worldwide, offering fast and secure online payments for businesses and consumers alike. With its widespread adoption, PayPal is trusted by millions of users, making it a convenient choice for both small businesses and large enterprises. It supports multiple currencies and payment methods, including credit cards, debit cards, and PayPal balance payments. Whether you’re selling products online or accepting donations, PayPal offers quick transactions, fraud protection, and a simple integration process.

Reviews

PayPal is praised for its ease of use, speed, and global reach. It’s often the go-to option for e-commerce businesses and online marketplaces. However, some users mention that the fees can be higher compared to other platforms, especially for international transactions. Additionally, the customer support experience can vary, with occasional complaints about limited responsiveness or resolution.

Features of PayPal

- Supports multiple payment methods (credit/debit cards, PayPal balance, and more)

- Handles transactions in over 100 currencies

- Offers integrated invoicing and subscription management

- Fast and secure payment processing with buyer and seller protection

- Mobile app available for managing payments on the go

- Robust fraud protection tools and easy dispute resolution

Pros of PayPal:

- Fast and easy to use

- Trusted by millions globally

- Supports a wide range of payment methods and currencies

- Buyer and seller protection features

Cons of PayPal:

- Transaction fees can be high, especially for international payments

- Customer support can be inconsistent

- Limited customization options compared to other platforms

Final Verdict

PayPal remains a top choice for fast and trusted online payments, especially for businesses looking to expand internationally. With its quick integration and global reach, it’s perfect for online stores, freelancers, and anyone needing a reliable payment system.

4- WorldPay – Best for UK-based businesses needing robust payment infrastructure

WorldPay is a global leader in payment processing, offering a comprehensive range of solutions tailored to UK-based businesses. Whether you’re an e-commerce site, a retail store, or a service provider, WorldPay provides robust tools to accept payments securely. From card payments to recurring billing, it handles all types of transactions and integrates easily with online stores and POS systems. Its strong infrastructure and local support make it ideal for UK businesses looking for reliable, scalable payment solutions.

Reviews

WorldPay is highly regarded for its reliability, flexible payment options, and excellent customer service. Businesses appreciate the wide array of supported payment methods, as well as the detailed reporting tools. Some users have noted that the setup process can be more complex compared to other platforms, and some fees can be difficult to understand at first.

Features of WorldPay

- Handles card payments, mobile payments, and online transactions

- Supports over 120 currencies and global payments

- Provides detailed reporting and analytics for tracking sales

- Secure fraud prevention tools and PCI DSS compliance

- Integrates seamlessly with e-commerce platforms and POS systems

- Offers recurring billing and subscription management options

Pros of WorldPay:

- Wide range of payment methods supported

- Strong fraud prevention and security features

- Reliable customer service and support

- Excellent for UK businesses with local payment infrastructure

Cons of WorldPay:

- Complex setup process for new users

- Transaction fees can vary based on volume and service packages

- Limited features for international businesses compared to some global platforms

Final Verdict

WorldPay is a trusted and versatile payment processor that’s especially suited for UK-based businesses needing a robust infrastructure. It offers comprehensive support for both online and in-person payments, making it a great choice for growing businesses that require scalability and security.

5- SumUp – Best for mobile card readers and small business transactions

SumUp is a user-friendly payment solution designed for small businesses and mobile merchants. Known for its portable card readers, SumUp enables businesses to accept in-person payments quickly and securely. It’s perfect for small businesses, pop-up shops, or service-based companies that need a straightforward, affordable payment solution on the go. With no monthly fees and competitive transaction rates, SumUp makes it easy for businesses to accept card payments wherever they are.

Reviews

SumUp is praised for its ease of use, affordability, and compact card readers. Small business owners love how quickly they can start accepting payments without the hassle of complicated contracts. Some users, however, have mentioned that the mobile app could offer more features for managing finances and that the transaction fees can add up for businesses with high-volume sales.

Features of SumUp

- Portable card readers that work with smartphones and tablets

- Accepts credit and debit card payments, including contactless

- No monthly fees—pay only per transaction

- Easy-to-use mobile app for managing payments and sales

- Simple setup and no long-term contracts required

- Fast transaction approval times

Pros of SumUp:

- No monthly fees—pay per transaction

- Easy-to-use mobile app and card readers

- Great for small businesses and mobile vendors

- Competitive transaction rates

Cons of SumUp:

- Limited features for businesses that need advanced reporting or analytics

- Transaction fees can add up for higher volumes

- Only suitable for small businesses or businesses with a mobile component

Final Verdict

SumUp is an excellent payment solution for small businesses, especially those that need a mobile-friendly, affordable way to accept card payments in person. Its simplicity and lack of monthly fees make it a top choice for entrepreneurs on the go.

6- iZettle – Best for point-of-sale solutions tailored to retailers and cafes

iZettle is a versatile point-of-sale (POS) solution that offers an affordable, easy-to-use payment processing system, perfect for small retailers, cafes, and service providers. Its intuitive interface, combined with mobile card readers, allows businesses to accept payments anywhere, whether they’re in-store or on the go. iZettle’s user-friendly software includes features like sales tracking, inventory management, and customer insights, making it a top choice for businesses looking to streamline their payment and sales processes.

Reviews

iZettle is appreciated for its simple, plug-and-play setup and reliability. Small business owners, particularly those in retail and hospitality, find it incredibly useful for processing payments with minimal effort. However, some users have noted that the transaction fees can be a bit high for businesses with larger volumes, and the lack of some advanced reporting tools may require third-party integrations.

Features of iZettle

- Mobile POS system with card readers for in-person payments

- Accepts credit and debit cards, including contactless payments

- Sales tracking and inventory management features

- Customer insights and marketing tools

- Simple, fast setup with no long-term contracts

- Compatible with iOS and Android devices

Pros of iZettle:

- Easy-to-use mobile POS with quick setup

- Great for small businesses and cafes

- Sales and inventory management features included

- Competitive transaction rates for small businesses

Cons of iZettle:

- Limited advanced features for larger businesses

- Transaction fees can be higher for high-volume sales

- Lacks some reporting and analytics options

Final Verdict

iZettle is a great choice for small businesses and cafes that need an affordable, reliable point-of-sale solution. It’s perfect for businesses that need a straightforward way to accept payments, manage sales, and track inventory—all with minimal upfront costs.

7- Shopify Payments – Best for eCommerce businesses using Shopify platform

Shopify Payments is an integrated payment processing solution for businesses using Shopify’s eCommerce platform. By offering seamless integration, it allows merchants to accept payments directly from their store without relying on third-party payment gateways. Shopify Payments simplifies transactions by handling credit card payments, digital wallets, and other common payment methods, all while offering secure processing and easy tracking of orders and payments within the Shopify dashboard.

Reviews

Shopify Payments is well-received for its seamless integration with Shopify stores, helping businesses avoid the hassle of dealing with external payment gateways. Many users appreciate the reduced transaction fees compared to third-party services. However, some customers have noted that it’s only available in certain countries, which can limit its accessibility for international businesses.

Features of Shopify Payments

- Integrated directly with Shopify’s eCommerce platform

- Supports credit card payments, Apple Pay, Google Pay, and more

- No additional transaction fees for Shopify users

- Integrated order and payment tracking within Shopify dashboard

- Easy to set up with automatic payouts

- Secure payment processing with PCI compliance

Pros of Shopify Payments:

- No additional transaction fees for Shopify stores

- Easy integration with Shopify platform

- Supports multiple payment methods, including digital wallets

- Secure, PCI-compliant payment processing

Cons of Shopify Payments:

- Available only in specific countries

- Limited customization options for payment flows

- May not work well with non-Shopify stores

Final Verdict

For eCommerce businesses already using Shopify, Shopify Payments is a no-brainer. Its seamless integration, low transaction fees, and secure processing make it one of the best payment options for online stores.

8- GoCardless – Best for recurring payments and direct debit processing

GoCardless specializes in managing recurring payments, offering a simple, secure way for businesses to collect payments through direct debits. Whether you’re handling subscriptions, memberships, or recurring services, GoCardless offers an efficient solution for businesses looking to streamline their billing processes. With its focus on ease of use and cost-effective pricing, GoCardless is a top choice for businesses with ongoing billing needs.

Reviews

GoCardless is praised for its simplicity, low fees, and seamless integration with accounting software like Xero and QuickBooks. Users appreciate how it handles recurring payments without the complexity of traditional payment processors. Some users, however, note that its support for one-time payments is limited, and it may not be the best fit for businesses with highly variable billing cycles.

Features of GoCardless

- Specializes in direct debit processing for recurring payments

- Integration with popular accounting software (Xero, QuickBooks, etc.)

- Low transaction fees for recurring payments

- Secure, automated payment collection with no setup fees

- Easy-to-use dashboard for tracking payments and managing subscriptions

- Global support for recurring payments in multiple currencies

Pros of GoCardless:

- Ideal for recurring payments and subscriptions

- Low transaction fees for direct debit processing

- Seamless integration with accounting software

- Secure and automated payment collection

Cons of GoCardless:

- Limited support for one-time or variable payments

- May not be suitable for businesses with diverse payment structures

- International availability may vary depending on country

Final Verdict

GoCardless is an excellent option for businesses that rely on recurring billing, subscriptions, or memberships. Its simple, cost-effective solution for direct debits makes it a top contender for businesses seeking to streamline their payment processes.

9- Amazon Pay – Best for eCommerce stores targeting Amazon users

Amazon Pay leverages Amazon’s trusted brand to offer a payment solution that allows customers to pay with the information already stored in their Amazon accounts. For eCommerce businesses, this is a huge advantage, as it allows them to provide a frictionless checkout experience for millions of Amazon shoppers. With its easy integration and security features, Amazon Pay is ideal for businesses targeting the vast Amazon marketplace.

Reviews

Amazon Pay is widely appreciated for its convenience, especially for customers who already have Amazon accounts. Merchants benefit from the trust and familiarity that Amazon brings to the payment process. Some users have mentioned that transaction fees can be slightly higher than other payment processors, and the platform is only available for online stores.

Features of Amazon Pay

- Allows customers to pay with their Amazon account credentials

- Seamless integration with eCommerce platforms like Shopify, WooCommerce, and Magento

- Secure payment processing with fraud protection

- Supports multiple payment methods (credit cards, debit cards, Amazon gift cards)

- Quick and easy checkout experience for Amazon customers

Pros of Amazon Pay:

- Easy checkout for Amazon users

- Integration with popular eCommerce platforms

- Trusted and secure payment processing

- Fraud protection features included

Cons of Amazon Pay:

- Transaction fees can be higher compared to other platforms

- Only available for online stores (not for physical retail)

- Limited customization options for checkout flows

Final Verdict

Amazon Pay is a great option for eCommerce businesses that want to offer a seamless, secure checkout experience for Amazon customers. Its integration with major eCommerce platforms and the trusted Amazon brand make it an appealing choice for online stores looking to boost conversions.

10- Adyen – Best for global enterprises needing multi-channel payment support

Adyen is a powerful, global payment solution designed for enterprises that require multi-channel support, including online, in-store, and mobile payments. With its comprehensive range of payment methods, including credit cards, digital wallets, and local payment solutions, Adyen caters to businesses that operate internationally. It also offers advanced fraud protection, reporting tools, and integration with major eCommerce platforms, making it a top choice for global enterprises.

Reviews

Adyen is praised for its seamless integration, ease of use, and global reach. Users appreciate the wide range of payment methods and the ability to process payments in multiple currencies. However, some customers have pointed out that Adyen’s pricing can be complex and may be more suitable for larger enterprises rather than small businesses.

Features of Adyen

- Supports payments across online, mobile, and in-store channels

- Accepts a wide range of global payment methods

- Advanced fraud prevention tools

- Multi-currency support for international transactions

- Detailed reporting and analytics for performance tracking

- Integration with popular eCommerce platforms (Shopify, Magento, etc.)

Pros of Adyen:

- Supports a wide variety of payment methods across channels

- Advanced fraud protection and security tools

- Multi-currency and global payment support

- Integration with eCommerce platforms

Cons of Adyen:

- Pricing structure can be complex and high for small businesses

- Setup may require a bit of technical knowledge

- May not be suitable for businesses with low transaction volumes

Final Verdict

Adyen is an excellent choice for global enterprises that require a versatile, multi-channel payment solution. Its robust fraud protection and global payment method support make it a top option for large businesses with international reach.

11- Cybersource – Best for secure enterprise-level payment processing

Cybersource, a subsidiary of Visa, offers secure, enterprise-level payment processing designed to meet the needs of large organizations. With its global reach, robust fraud management tools, and comprehensive payment solutions, Cybersource ensures that businesses can securely process payments while adhering to international compliance standards. Its flexible API and detailed reporting features also make it ideal for businesses that need customized payment solutions.

Reviews

Cybersource is highly regarded for its security features, including fraud detection and risk management. Users value the wide range of payment options it offers and its ability to support businesses of all sizes. However, the platform can be complex for small businesses to navigate, and some users report a steep learning curve when setting up integrations.

Features of Cybersource

- Secure payment processing with Visa’s fraud prevention technology

- Multi-currency and multi-country payment support

- Real-time reporting and analytics tools

- API for custom payment integrations

- PCI-DSS compliant for secure transactions

- Risk management and fraud detection tools

Pros of Cybersource:

- Strong fraud protection and security features

- Multi-currency and multi-country support

- Real-time reporting and analytics tools

- API for custom payment integrations

Cons of Cybersource:

- Can be difficult to navigate for smaller businesses

- Setup and integration may require technical expertise

- Pricing may not be as cost-effective for small businesses

Final Verdict

Cybersource is ideal for large enterprises that prioritize security and need a flexible, customizable payment solution. Its comprehensive fraud protection and integration capabilities make it a top choice for businesses with complex payment processing needs.

12- Opayo – Best for UK SMEs needing reliable payment gateway services

Opayo, formerly known as Sage Pay, is a UK-based payment gateway solution that provides reliable and secure payment processing for small and medium-sized enterprises (SMEs). With its easy integration, competitive pricing, and excellent customer support, Opayo is perfect for businesses looking to accept payments securely while managing online and in-store transactions. Opayo supports all major credit and debit cards, digital wallets, and recurring payments.

Reviews

Opayo is praised for its simplicity, reliability, and the excellent customer service provided. Users appreciate the ease of integration with various platforms and the ability to manage payments both online and offline. However, some businesses feel that the platform lacks certain advanced features found in other, more comprehensive payment solutions.

Features of Opayo

- Supports credit card, debit card, and digital wallet payments

- Recurring billing options for subscriptions and memberships

- Real-time reporting and transaction management tools

- Easy integration with popular eCommerce platforms

- Secure payment gateway with PCI compliance

- Reliable customer support for troubleshooting

Pros of Opayo:

- Simple, easy-to-use platform for UK SMEs

- Competitive pricing and transparent fees

- Strong security and PCI compliance

- Excellent customer support

Cons of Opayo:

- Lacks some advanced features compared to other payment gateways

- Limited to the UK market, with less international support

- No advanced fraud protection tools for large businesses

Final Verdict

Opayo is an ideal choice for UK-based SMEs that need a reliable and secure payment gateway service. Its simplicity, excellent customer support, and affordable pricing make it a great option for small businesses looking to accept payments with minimal hassle.

13- Cashflows – Best for flexible and fast UK business payments

Cashflows offers a highly flexible and efficient payment processing solution designed specifically for UK-based businesses. With its range of payment options, including card payments, direct debits, and bank transfers, Cashflows helps businesses accept payments quickly and securely. Its easy-to-use interface and customizability make it suitable for businesses of all sizes, from small startups to larger enterprises, providing seamless integrations with eCommerce platforms and accounting tools.

Reviews

Cashflows is praised for its versatility, speed, and ease of integration. Users appreciate the variety of payment methods available and the fast processing times. However, some users report that the setup process can be a bit complex for businesses that are new to payment processing solutions.

Features of Cashflows

- Accepts card payments, direct debits, and bank transfers

- Real-time transaction processing and reporting

- Seamless integrations with eCommerce platforms and accounting software

- Secure and PCI-compliant payment gateway

- Customizable payment solutions for different business needs

Pros of Cashflows:

- Flexible payment options for businesses of all sizes

- Quick transaction processing times

- Easy integration with accounting and eCommerce tools

- PCI-compliant and secure payment gateway

Cons of Cashflows:

- Setup process can be complex for new users

- Lacks advanced fraud prevention features

- Limited international payment support

Final Verdict

Cashflows is ideal for businesses that need a fast, secure, and flexible payment processing solution. Its customizable payment options and ease of integration make it an excellent choice for UK businesses looking to streamline their payment processes.

14- Revolut – Best for modern businesses needing integrated financial tools and payments

Revolut is a cutting-edge financial technology platform that offers a range of services beyond just payment processing. Perfect for modern businesses, Revolut allows companies to manage payments, international transactions, and even cryptocurrency all in one place. Its integrated financial tools, including expense management and financial reporting, make it a comprehensive solution for businesses looking to streamline operations while keeping payment processing secure and efficient.

Reviews

Revolut is highly regarded for its all-in-one solution that integrates financial services with payment processing. Users love the ability to manage multiple currencies, make international payments, and track expenses in one place. However, some businesses find that the platform’s advanced features can be overwhelming and may not be necessary for smaller operations.

Features of Revolut

- Multi-currency accounts and international payments

- Instant payment processing and access to global payment methods

- Cryptocurrency support and exchange

- Integrated financial tools, including expense management and reporting

- Secure, PCI-compliant payment gateway

- Mobile and desktop apps for managing finances on the go

Pros of Revolut:

- Comprehensive financial tools beyond payment processing

- Multi-currency and international payment support

- Cryptocurrency capabilities

- Easy-to-use mobile and desktop apps

Cons of Revolut:

- Advanced features can be overwhelming for smaller businesses

- Some features are limited to specific plans or regions

- Customer support can be slow at times

Final Verdict

Revolut is perfect for businesses that want an all-in-one platform to manage their payments, expenses, and finances. Its range of integrated financial tools makes it a standout choice for modern businesses that need flexibility and global reach.

15- Stax – Best for subscription-based pricing and predictable payment processing costs

Stax is a payment processing solution that focuses on providing subscription-based pricing to businesses, offering predictability and transparency in payment processing costs. Ideal for subscription-based businesses, Stax eliminates per-transaction fees and offers a flat monthly rate, making it easier for companies to manage their payment expenses. With its robust reporting tools and seamless integrations with other business systems, Stax is perfect for businesses looking to control costs and optimize their payment processes.

Reviews

Stax is praised for its cost-effective pricing model and user-friendly interface. Businesses appreciate the predictable subscription pricing that helps them budget effectively. However, some users note that it may not be suitable for companies with low transaction volumes due to the flat-rate pricing structure.

Features of Stax

- Subscription-based pricing with no per-transaction fees

- Advanced reporting and analytics tools for payment tracking

- Seamless integration with other business systems, including CRMs and accounting tools

- Secure and PCI-compliant payment processing

- Multiple payment method support, including credit and debit cards

Pros of Stax:

- Subscription-based pricing with no per-transaction fees

- Predictable and transparent payment processing costs

- Advanced reporting and analytics tools

- Secure and PCI-compliant payment processing

Cons of Stax:

- May not be cost-effective for businesses with low transaction volumes

- Limited support for international payments

- Customer support can be slow at times

Final Verdict

Stax is an excellent choice for businesses looking for predictable payment processing costs. Its subscription-based pricing model and robust reporting tools make it a standout option for companies that need transparency and cost control.

Frequently Asked Questions (FAQs)

What is the best credit card processing software for small businesses?

Square and PayPal are great for small businesses due to their simplicity, no monthly fees, and easy setup.

Can I use credit card processing software for online payments?

Yes, platforms like Stripe, PayPal, and Shopify Payments are perfect for handling online transactions securely.

What payment software supports international transactions?

Revolut, PayPal, and Stripe support international transactions and multiple currencies.

Is there a credit card processing solution with no transaction fees?

Stax offers a subscription model with no per-transaction fees, ideal for high-volume businesses.

What are the security features to look for in credit card processing software?

Look for PCI compliance, encryption, fraud protection, and multi-factor authentication to ensure secure payments.

How do I choose the right credit card processing software for my business?

Consider transaction fees, ease of integration, security features, and any additional tools you might need.