#1. Capture Expense

Capture Expense is an AI-driven platform designed with UK tax regulations at its core. Its focus on VAT and HMRC compliance makes it uniquely valuable for British companies aiming to minimize errors and automate tax reporting.

Features

- AI-powered receipt scanning: Automatically extracts data, reducing manual entry.

- Automatic VAT extraction: Identifies VAT amounts on receipts and flags discrepancies.

- HMRC-compliant reporting: Generates audit-ready VAT reports aligned with UK standards.

- Mileage tracking: GPS-enabled tracking with automated mileage calculations.

- WhatsApp integration: Allows employees to submit receipts quickly via WhatsApp.

- Real-time spend dashboards: Visualize company expenses as they happen.

- Global multi-currency support: For companies with international transactions.

Benefits

Capture Expense reduces manual errors by automating the time-consuming parts of expense management, saving finance teams hours each week. The WhatsApp integration caters to employee convenience, increasing compliance rates. Its VAT automation not only saves money but also ensures HMRC readiness during audits.

Pricing

Pricing is tailored to the size and needs of your business, with bespoke quotes reflecting your volume of expenses and required features.

Final Verdict

Capture Expense is the go-to choice for UK companies serious about VAT compliance and leveraging AI to reduce expense management burden.

#2. Moss

Moss combines smart company cards with real-time spend controls and automated bookkeeping, targeting UK SMEs seeking financial visibility and budget discipline.

Features

-

Virtual and physical cards: Issue employee cards with customizable limits.

-

Budget control: Set monthly and project budgets with spend alerts.

-

Automated receipt capture: Employees submit receipts instantly via mobile app.

-

Accounting integrations: Syncs data with Xero, QuickBooks, and Sage.

-

Multi-currency support: Ideal for businesses with overseas spending.

-

Approval workflows: Automated spending approvals to enforce company policies.

Benefits

Moss empowers finance managers with real-time control and visibility, reducing the risk of overspending. Its user-friendly mobile app drives high adoption and simplifies employee reimbursement. The platform’s strong integration with popular UK accounting software makes reconciliation effortless.

Pricing

Moss pricing depends on card usage and features, typically involving a monthly fee plus transaction costs.

Final Verdict

A highly adaptable and transparent solution tailored for UK SMEs prioritizing budget control and real-time expense visibility.

#3. ExpenseIn

ExpenseIn offers an open-source expense management system, appealing to UK organizations with the resources to customize workflows and maintain an in-house solution.

Features

-

Automated receipt scanning: Speeds up data entry.

-

Real-time reporting: Offers insights into company spend trends.

-

Policy enforcement: Configurable workflows to ensure compliance.

-

Integration: Connects with payroll and accounting software.

-

Open-source: Allows businesses to tailor the platform to their exact needs.

Benefits

The open-source nature of ExpenseIn enables full customization, making it ideal for companies with unique expense policies or integration requirements. Transparency and control over data are enhanced, which is crucial for businesses prioritizing data security.

Pricing

ExpenseIn is free to use, but paid support and customization services are available.

Final Verdict

Best suited for UK businesses with internal IT capabilities wanting a flexible, customizable expense platform.

#4. Pleo

Pleo delivers a modern expense management experience through smart company cards paired with automated expense reporting and VAT management.

Features

-

Virtual & physical cards: Controlled spending per user.

-

Receipt matching: Automates reconciliation by matching receipts to transactions.

-

VAT reclaim: Automatically identifies VAT for reclaiming.

-

Accounting integrations: Compatible with Xero, QuickBooks, and others.

-

Real-time budget tracking: Transparency for both employees and finance teams.

Benefits

Pleo simplifies the process of expense reporting, reducing errors and manual work. The card system empowers employees with controlled access to company funds while ensuring spend is visible and compliant.

Pricing

Plans start at £6–£9 per user per month, scaling with added features.

Final Verdict

A seamless, user-friendly expense management tool perfect for UK SMEs wanting integrated card programs and automation.

#5. Rippling

Rippling integrates expense management with HR and IT systems, offering a unified platform especially beneficial to UK multinational companies.

Features

-

Multi-currency expenses: Submission and approvals worldwide.

-

Automated approvals: Custom workflows reduce bottlenecks.

-

Global payroll integration: Streamlines reimbursements.

-

IT asset tracking: Bundled with expense management for comprehensive workforce control.

-

Compliance analytics: Monitors adherence to spending policies globally.

Benefits

Rippling eliminates siloed systems by combining expense management with HR and IT, improving operational efficiency for large UK organizations with global workforces.

Pricing

Custom pricing depending on features and number of users.

Final Verdict

Ideal for complex, multinational UK companies needing integrated workforce and expense solutions.

#6. Tide

Tide is a UK-based digital banking platform offering business accounts with integrated expense management features tailored for SMEs.

Features

-

Business credit and debit cards: Issue physical and virtual cards with spending limits.

-

Real-time expense tracking: Monitor transactions instantly via mobile app.

-

Automated expense categorization: Simplifies bookkeeping and reporting.

-

Approval workflows: Streamline spending approvals for better control.

-

Accounting integrations: Syncs with Xero and QuickBooks for seamless reconciliation.

Benefits

Tide’s expense cards offer an affordable way for UK SMEs to manage company spending without complicated processes. The mobile-first design ensures that employees can submit expenses and track budgets effortlessly, increasing transparency.

Pricing

Tide charges competitive fees with no monthly maintenance fees for standard accounts, making it accessible to small businesses.

Final Verdict

An excellent solution for UK startups and small businesses seeking straightforward expense cards coupled with basic management tools.

#7. Navan (formerly TripActions)

Navan provides a comprehensive travel and expense management platform ideal for enterprises with frequent global business travel.

Features

-

Unified travel booking and expense reporting: Consolidate travel and expenses in one platform.

-

Policy compliance: Automated spend controls to enforce company policies.

-

Multi-currency support: Handles expenses and reimbursements worldwide.

-

Automated receipt capture: Reduces manual data entry with smart scanning.

-

Advanced analytics: Detailed dashboards to monitor travel spend.

Benefits

Navan excels in reducing administrative overhead by integrating travel booking with expense reporting. This unified approach provides enterprises with full visibility and control over employee spend, reducing fraud and simplifying compliance.

Pricing

Custom pricing tailored to enterprise size and travel volume.

Final Verdict

Best suited for UK large enterprises requiring an end-to-end global travel and expense solution.

#8. Zoho Expense

Zoho Expense is a cost-effective, cloud-based expense management software aimed at small to medium UK businesses.

Features

-

Automated expense reporting: Auto-imports expenses and receipts.

-

Multi-currency and mileage tracking: Supports international transactions.

-

Policy enforcement: Set custom approval workflows and spending limits.

-

Mobile app: Enables easy receipt capture and approval on the go.

-

Integrations: Works seamlessly with Zoho ecosystem, Xero, QuickBooks, and more.

Benefits

Zoho Expense balances affordability with functionality, making it attractive for UK SMEs. Its integration with other Zoho products allows businesses to extend capabilities without complexity.

Pricing

Offers a free plan for up to three users; paid plans start at £2.50 per user/month.

Final Verdict

A practical, budget-friendly option for UK SMEs seeking solid expense management with easy scalability.

#9. Payhawk

Payhawk is a versatile spend management platform emphasizing multi-entity expense control and automated VAT compliance.

Features

-

Corporate card issuance: Control employee spending with virtual and physical cards.

-

VAT automation: Automatically extracts VAT for reporting and reclaim.

-

Multi-entity management: Ideal for companies with multiple subsidiaries.

-

OCR receipt scanning: Supports 60+ languages, speeding up processing.

-

Accounting software integrations: Syncs with major platforms for effortless reconciliation.

Benefits

Payhawk empowers UK businesses with complex structures to centralize spend control and compliance, especially for VAT-heavy industries. Its advanced OCR technology and multilingual support benefit global operations.

Pricing

Pricing targets mid-market and enterprise clients with custom quotes based on features and user numbers.

Final Verdict

Perfect for UK companies needing scalable, multi-entity spend management with robust VAT automation.

#10. Sage Intacct

Sage Intacct is part of the Sage financial suite, providing project-centric expense management geared towards UK professional services firms.

Features

-

Project-based expense allocation: Track expenses by client and project.

-

Time tracking: Integrates billable hours with expense claims.

-

Automated approvals: Custom workflows ensure compliance.

-

Financial reporting: Comprehensive insights into project costs and profitability.

-

Seamless integration: Works with Sage’s accounting and payroll products.

Benefits

Sage Intacct excels at managing complex financial workflows common in consultancies, law firms, and agencies, providing transparency into project expenses and client billing.

Pricing

Custom pricing depending on company size and chosen modules.

Final Verdict

Ideal for UK businesses with complex project billing and detailed expense tracking needs.

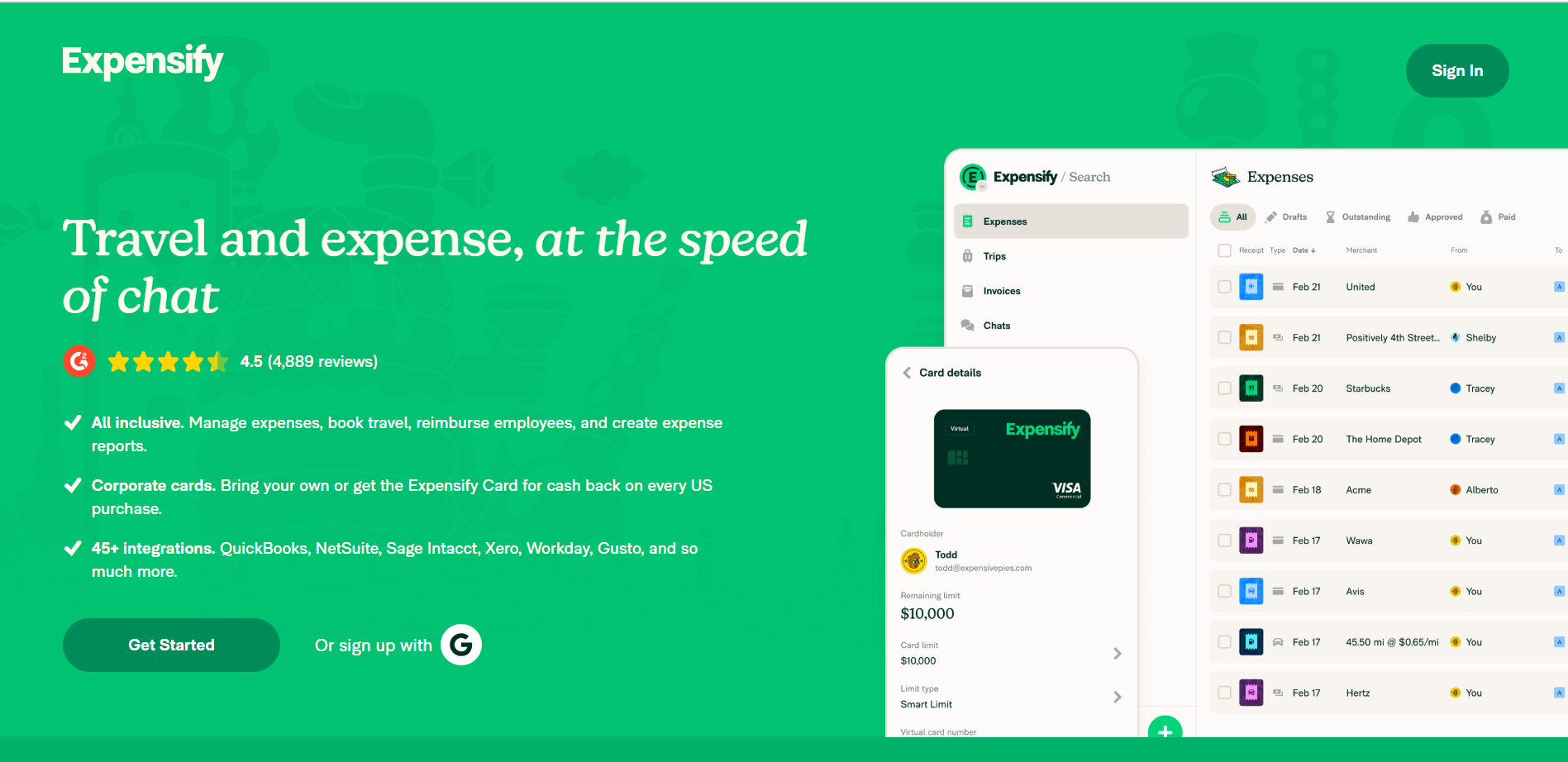

#11. Expensify

Expensify is a mobile-first expense management solution highly valued for its smart receipt capture and ease of use.

Features

-

SmartScan technology: Captures and digitizes receipts quickly and accurately.

-

Automated expense report creation: Reduces manual input with automated report generation.

-

Credit card syncing: Automatically imports transactions and matches receipts.

-

Multi-level approval workflows: Supports custom expense approval chains.

-

Integration: Compatible with major accounting software such as Xero and QuickBooks.

Benefits

Expensify’s strong mobile app and smart scanning technology make it an excellent choice for UK SMEs and startups who want to simplify expense reporting on the go. The automation reduces errors and speeds up reimbursement.

Pricing

Pricing plans start at around $5 per user per month with custom enterprise solutions available.

Final Verdict

A practical and efficient solution for UK businesses looking for fast, mobile-friendly expense capture and reporting.

#12. SAP Concur

SAP Concur is a leading enterprise-grade solution offering integrated travel, expense, and invoice management.

Features

-

Travel and expense management: Consolidates travel bookings with expense reporting.

-

Policy enforcement: Automated compliance with corporate spend policies.

-

Global multi-currency support: Suitable for international operations.

-

Advanced analytics: Spend forecasting and detailed insights.

-

Mobile app: On-the-go expense capture and approvals.

Benefits

SAP Concur is favored by large UK enterprises due to its comprehensive capabilities and scalability. Its ability to handle complex travel policies and international compliance makes it indispensable for multinational organizations.

Pricing

Custom enterprise pricing based on company size and feature requirements.

Final Verdict

The preferred choice for large UK corporations seeking end-to-end travel and expense management solutions.

#13. Spendesk

Spendesk offers a comprehensive spend management platform combining expense cards, invoice management, and budget control features.

Features

-

Virtual and physical prepaid cards: Empower employees with controlled spending.

-

Invoice processing and approval: Simplifies supplier payments and tracking.

-

Real-time spend dashboards: Monitor expenses and budgets transparently.

-

VAT compliance automation: Helps recover VAT accurately.

-

Accounting integrations: Connects with popular systems like Xero and Sage.

Benefits

Spendesk’s all-in-one approach provides UK SMEs with transparency and control over company spending, improving budget adherence and simplifying finance operations.

Pricing

Pricing is customized based on company size and usage, typically targeting mid-market firms.

Final Verdict

Ideal for UK businesses seeking centralized control over cards, invoices, and budgets in one platform.

#14. The Access Group (Access Expense)

Access Expense is a cloud-based expense management solution tailored for UK businesses, emphasizing compliance and ease of use.

Features

-

HMRC-compliant mileage and expense claims: Ensures regulatory adherence.

-

Automated credit card transaction matching: Speeds up reconciliation.

-

Policy enforcement and approval workflows: Customizable and automated.

-

Integration: Works seamlessly with Access Group’s payroll and finance modules.

-

Mobile app: Allows employees to submit expenses anywhere.

Benefits

Access Expense is widely trusted in the UK for simplifying expense processes and ensuring compliance with tax laws, particularly beneficial for businesses that rely on the Access ecosystem.

Pricing

Custom pricing based on business needs and number of users.

Final Verdict

The go-to platform for UK businesses prioritizing compliance and integration with payroll systems.

#15. Xero

Xero is a popular cloud accounting software in the UK with integrated expense management features suitable for SMEs.

Features

-

Mobile receipt scanning and expense claims: Capture expenses on the go.

-

Mileage tracking: Automatic GPS-based tracking.

-

Direct reimbursement: Expenses can be reimbursed through payroll seamlessly.

-

Bank feeds and reconciliation: Automatic import of bank transactions.

-

Real-time cash flow insights: Helps businesses maintain healthy finances.

Benefits

Xero’s tight integration between accounting and expense management simplifies bookkeeping for UK small businesses. Its intuitive interface and affordable pricing make it accessible for growing companies.

Pricing

Plans start from around £10–£30 per month depending on features.

Final Verdict

Ideal for UK small businesses already using Xero who want to streamline their expense tracking alongside accounting.