Payroll software has become a vital tool for businesses of all sizes in 2026. From automating salary calculations to ensuring tax compliance, these systems simplify and streamline every aspect of payroll management. As global regulations tighten and employee expectations rise, organizations are turning to payroll tools to reduce manual errors, avoid penalties, and stay legally compliant.

Today, more than 90% of businesses rely on payroll software to handle tasks such as payslip generation, pension contributions, RTI submissions, and more. Industry leaders like Deloitte, Unilever, and IBM use sophisticated payroll systems to ensure timely payments and manage their workforce efficiently. These tools are increasingly integrating with HR and accounting platforms, allowing seamless data flow and improved productivity across departments.

What makes a payroll system truly exceptional? Features like cloud-based access, real-time updates, employee self-service portals, and automated tax filing are now expected. Whether you’re a startup managing a handful of staff or a global enterprise with thousands of employees, there’s a solution designed to match your specific needs.

In short, here are the most popular payroll software options for 2026:

- Gusto – Best for Modern Small Businesses

- ADP Workforce Now – Best for Enterprise-Grade Global Payroll

- QuickBooks Payroll – Best for Small Businesses with Built-In Accounting

- Paychex Flex – Best for Scalable HR and Payroll Services

- Deel – Best for Contractor and International Compliance

Want a ranked overview of the top 15 payroll software programs in 2025 covering everything from compliance to cloud automation? Let’s dive in!

Top 15 Best Payroll Software in 2026

- e-Boekhouden.nl – Best for UK businesses with easy invoicing, VAT support, and real-time insights.

- Moss – Best for streamlines spend management and corporate card control for modern businesses.

- Ficsus.nl– Best for online accounting for freelancers and small businesses.

- MoneyMonk – Best for project-based accounting for freelancers and service providers.

- AFAS SB– Best for automates accounting, HR, and invoicing for streamlined business management.

- Visma eAccounting – Best for smart, cloud-based bookkeeping for small businesses.

- InformerOnline– Best for intuitive online accounting for freelancers and SMEs.

- Moneybird – Best for invoicing and accounting for entrepreneurs and freelancers.

- Kleisteen – Best for straightforward online accounting for small businesses and non-profits.

- Papaya Global – Best for Global Workforce Compliance

- FreeAgent Payroll – Best for Freelancers and Contractors

- Reed HR Payroll Software – Best for HR Teams Needing Built-In Payroll Support

- Pento – Best for Modern, Real-Time Payroll Automation

- Staffology – Best for Flexible, API-Friendly Cloud Payroll

- SnelStart – Best for bookkeeping and invoicing for small UK businesses.

Before You Begin…

Selecting the right payroll software is a strategic decision that affects employee trust, financial accuracy, and legal compliance. With a wide range of solutions available, aligning features with your business size, location, and sector is crucial. What works for a global enterprise may overwhelm a startup and vice versa.

“A payroll system isn’t just about paying employees it’s about building trust, ensuring compliance, and protecting your business from costly errors,” says Angela Webb, Senior Payroll Consultant at TechBench Global.

Questions to Ask When Choosing Payroll Software

- Does it handle tax compliance and pension contributions for your region?

- Can employees view payslips and update personal details online?

- Does it integrate with your accounting and HR systems?

- Is it scalable as your workforce grows or becomes more remote?

- Does it offer automation for RTI submissions, holiday pay, and bonuses?

Each payroll tool featured has been carefully reviewed based on these questions. Let’s break down each one in detail to help you make the best decision for your business.

How This Top 15 List Was Created

Our editorial team evaluated over 50 payroll solutions based on key factors like automation, compliance, integration, pricing, and user satisfaction. We tested features such as payslip generation, tax calculations, and direct deposit functionality. We also collected verified user reviews from companies of all sizes to measure ease of use, support quality, and real-world performance.

Whether you’re a freelancer, a growing startup, or a multinational enterprise, this list includes payroll solutions tailored to your needs. Let’s explore each program’s strengths in the sections ahead.

Differences in Pricing and Pricing Models

When comparing payroll software, understanding the pricing models is crucial for choosing a solution that fits your business size, complexity, and compliance needs. Some platforms cater to startups with low-cost plans, while others offer advanced tools for enterprises managing thousands of employees across regions.

Price Comparison for Small Businesses

Payroll solutions like Gusto, Patriot Payroll, and QuickBooks Payroll are tailored for small to midsize businesses. These platforms are cost-effective, easy to use, and include key features such as:

- Automatic payroll runs and tax filings

- Employee self-service portals

- Simple onboarding tools

- Transparent monthly pricing per employee

These tools are ideal for companies with fewer than 50 employees that need reliable payroll processing without overpaying for enterprise features.

Price Comparison for Midsize to Large Businesses

Larger organizations often require advanced features and scalability. Software like ADP Workforce Now, Paychex Flex, and SAP SuccessFactors offer enterprise-grade payroll capabilities, including:

- Multi-country payroll and compliance support

- Customizable reporting and analytics

- HR integrations and performance management

- Scalable pricing based on workforce size and complexity

These systems are designed to manage high volumes of data, complex deductions, and evolving legal requirements making them suitable for businesses undergoing growth or operating across jurisdictions.

Wondering which payroll software will best streamline your HR operations and ensure full compliance?Let’s dive into a detailed look at each of the Top 15 Payroll Platforms for 2026.

#1 – e-Boekhouden.nl – Best for Freelancers and Small Businesses

e-Boekhouden.nl is a top choice for UK freelancers, sole traders, and small businesses looking for simple yet powerful online accounting. Designed with ease-of-use in mind, it offers automated bookkeeping, invoicing, and VAT filing—ideal for users without an accounting background. The platform is fully cloud-based, making it easy to manage finances anytime, anywhere.

Review:

e-Boekhouden.nl is known for its intuitive workflow, allowing users to send professional invoices, reconcile bank transactions, and generate financial reports with just a few clicks. It’s HMRC-compliant and supports automatic VAT returns. Ideal for startups and sole traders, the software offers useful features like bank integration, real-time dashboards, and expense tracking—without overwhelming users.

Features of e-Boekhouden.nl:

- Automated bookkeeping and invoicing

- VAT calculation and HMRC-compliant filing

- Bank feeds and transaction matching

- Customer and supplier management

- Free support and training for new users

Final Verdict:

e-Boekhouden.nl is a reliable solution for UK-based freelancers and small businesses seeking a low-cost, easy-to-learn platform for managing their finances. Its automation features reduce manual work and help ensure compliance with UK tax regulations.

Pros of e-Boekhouden.nl:

- User-friendly and beginner-friendly

- Affordable plans with essential features

- Excellent support and onboarding help

- HMRC-compliant VAT filing

Cons of e-Boekhouden.nl:

- Limited scalability for large enterprises

- Interface may feel basic for advanced users

- Fewer integrations compared to global platforms

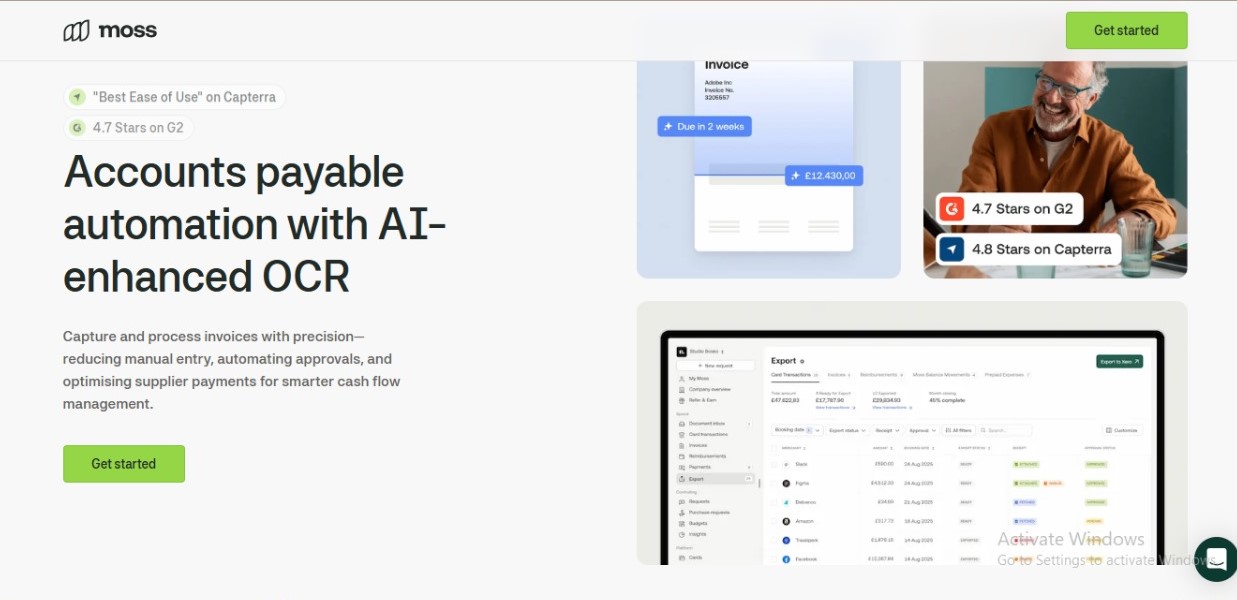

#2 –Moss – Best for Smart Spend Management and Corporate Control

Moss is a cutting-edge spend management platform built for modern businesses that want control, visibility, and automation in their financial operations. From corporate cards to invoice processing and approval workflows, Moss empowers finance teams to simplify expense tracking while maintaining real-time budget oversight across departments.

Review:

Moss stands out for its ability to unify expense reporting, approvals, card issuance, and accounting integration in one seamless platform. It allows companies to issue physical and virtual cards with spending rules, automate invoice management, and sync effortlessly with tools like DATEV, Xero, and QuickBooks. Moss is particularly valuable for startups and SMEs that need smart controls without slowing down operations.

Features of Moss:

- Smart corporate cards with custom limits

- Automated invoice capture and approval workflows

- Real-time budget tracking and reporting

- Integration with leading accounting software

- Multi-user roles and spending transparency

Final Verdict:

Moss is a top-tier solution for companies seeking an all-in-one expense management system that grows with them. Its focus on automation, control, and integration makes it ideal for businesses looking to replace outdated, manual processes with a smarter alternative.

Pros of Moss:

- Excellent spend control with real-time tracking

- Fast card issuance (virtual and physical)

- Streamlined invoice and approval workflows

- Strong integrations with accounting tools

Cons of Moss:

- Not ideal for very small businesses or freelancers

- May require onboarding for full feature use

- Limited availability outside select regions

#3 –Ficsus.nl – Best for Freelancers and Sole Traders

Ficsus.nl is tailored specifically for freelancers and sole traders who need a simple, reliable way to manage their accounting online. With automated features for invoicing, tax calculations, and expense tracking, Ficsus.nl helps self-employed professionals in the UK and beyond stay compliant without needing deep financial expertise.

Review:

Ficsus.nl stands out for its clean interface and focus on ease-of-use. It automates key tasks like VAT reporting and mileage tracking, and allows users to send invoices, manage clients, and monitor income—all from a single dashboard. For new freelancers, Ficsus.nl offers guides and support that make the software beginner-friendly.

Features of Ficsus.nl:

- Online invoicing and expense tracking

- Automated VAT and income tax calculations

- Bank feed integration and reconciliation

- Mileage and travel expense logging

- Free onboarding and knowledge resources

Final Verdict:

Ficsus.nl is a smart, affordable choice for freelancers who want to focus on their work while staying on top of their finances. Its automation tools, tax features, and simplicity make it a go-to platform for the self-employed.

Pros of Ficsus.nl:

- Built specifically for freelancers

- Easy-to-use interface with clear workflows

- Automated tax and mileage tracking

- Low-cost plans with essential tools

Cons of Ficsus.nl:

- Limited scalability for growing teams

- Fewer integrations than larger platforms

- Basic interface may not suit advanced users

#4 –MoneyMonk – Best for Project-Based Freelancers and Consultants

MoneyMonk is purpose-built for freelancers and service-based professionals who work on projects and bill by the hour or milestone. It combines accounting, time tracking, project management, and invoicing into one seamless platform—making it ideal for consultants, engineers, and creative professionals.

Review:

MoneyMonk shines in helping project-based businesses track time, manage tasks, and generate detailed invoices effortlessly. It supports automatic VAT filing, bank connections, and real-time reporting. What sets it apart is its ability to link hours worked directly to invoices and financial insights, giving freelancers full control over both billing and bookkeeping.

Features of MoneyMonk:

- Time tracking and project-based invoicing

- Expense management and mileage logging

- Bank sync and real-time financial reports

- VAT and income tax support

- Calendar and task planning tools

Final Verdict:

MoneyMonk is an excellent solution for freelancers who manage multiple clients and need full visibility over hours, projects, and payments. With its intuitive tools and automation, it reduces admin time and ensures more accurate billing.

Pros of MoneyMonk:

- Ideal for service providers and project workers

- Integrated time tracking and invoicing

- Strong reporting and tax support

- Clean, modern user interface

Cons of MoneyMonk:

- Not suitable for product-based businesses

- Limited to freelancers and solo professionals

- Fewer third-party integrations

#5 –AFAS SB – Best for All-in-One Business Automation

AFAS SB (Small Business) is a powerful platform designed for small to mid-sized companies that want to automate accounting, HR, and operational workflows in one system. With a strong focus on integration and efficiency, AFAS SB simplifies daily processes—from invoicing and payroll to reporting and CRM.

Review:

AFAS SB sets itself apart by offering a fully integrated suite that connects accounting, human resources, payroll, and project management. It allows businesses to eliminate manual data entry, reduce errors, and streamline compliance. The system is highly configurable, making it suitable for businesses with specific workflow needs and internal policies.

Features of AFAS SB:

- Integrated accounting and payroll processing

- HRM tools with digital personnel files

- Automated invoicing and approval flows

- Real-time dashboards and financial insights

- CRM and project tracking in one system

Final Verdict:

AFAS SB is ideal for growing companies looking to centralize business functions under one roof. With powerful automation, built-in compliance, and a customizable setup, it supports more than just accounting—it supports the entire business process.

Pros of AFAS SB:

- All-in-one platform for finance, HR, and CRM

- Excellent automation and workflow tools

- Customizable reports and dashboards

- Scalable for growing businesses

Cons of AFAS SB:

- Steeper learning curve for new users

- May be too feature-rich for small freelancers

- Pricing can be high for smaller teams

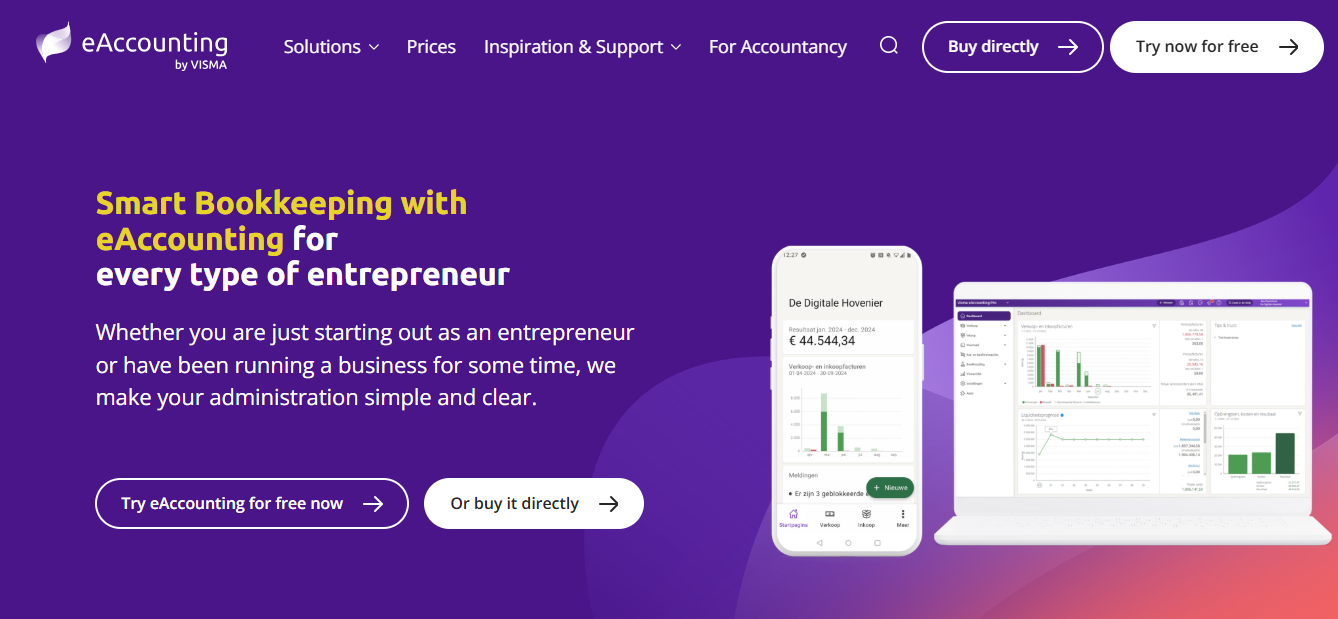

#6 –Visma eAccounting – Best for Small Businesses Wanting Smart Automation

Visma eAccounting is a cloud-based accounting solution tailored for small businesses and entrepreneurs who want to automate their finances without complexity. With features like smart invoicing, bank connectivity, and VAT compliance, it helps UK businesses stay organized and tax-ready with minimal effort.

Review:

Visma eAccounting simplifies core financial tasks such as invoicing, bank reconciliation, and reporting. Its automated workflows reduce manual work, while real-time insights help users stay on top of cash flow and obligations. Built with small business needs in mind, it supports multi-device access and seamless collaboration with accountants.

Features of Visma eAccounting:

- Smart invoicing and automated reminders

- Bank feeds and transaction matching

- VAT reporting and HMRC compliance

- Real-time dashboard for financial overview

- Mobile app for on-the-go accounting

Final Verdict:

Visma eAccounting is a reliable choice for small UK businesses looking for modern accounting software with intelligent automation. Its clean interface, solid compliance support, and cloud access make it ideal for entrepreneurs who want efficiency and clarity.

Pros of Visma eAccounting:

- Easy to use with clean UI

- Automated bank reconciliation

- Great for VAT and local compliance

- Strong mobile functionality

Cons of Visma eAccounting:

- Limited customization for advanced users

- May not suit complex or multi-entity businesses

- Some features locked behind higher-tier plans

#7 –InformerOnline – Best for Real-Time Accounting and Automation

InformerOnline is a modern cloud accounting platform built for freelancers, startups, and SMEs that want fast, real-time financial management. With automation at its core, InformerOnline simplifies tasks like invoicing, VAT returns, and bank reconciliation—making it ideal for entrepreneurs who value speed and insight.

Review:

InformerOnline stands out with its real-time financial dashboard, automatic bank feeds, and smart invoice processing. It’s designed to reduce admin by automating repetitive tasks and ensuring businesses stay compliant with tax regulations. It also offers seamless collaboration between entrepreneurs and their accountants via cloud access.

Features of InformerOnline:

- Real-time financial overview and reporting

- Smart invoicing and payment reminders

- Direct bank connections for auto reconciliation

- VAT and tax filing support

- Accountant collaboration features

Final Verdict:

InformerOnline is a strong contender for UK freelancers and small businesses looking to automate their financial tasks. Its real-time updates and accountant-ready features make it an efficient and transparent solution for managing day-to-day bookkeeping.

Pros of InformerOnline:

- Real-time data with visual dashboards

- Simple and fast invoicing tools

- Great for tax filing and compliance

- Smooth collaboration with accountants

Cons of InformerOnline:

- Limited features for larger or complex businesses

- Fewer integrations than larger platforms

- Interface may feel basic to advanced users

#8 –Moneybird – Best for Freelancers and Entrepreneurs Who Want Flexibility

Moneybird is a user-friendly online accounting tool designed for freelancers, creatives, and small business owners who need flexible invoicing, expense tracking, and tax management. With an intuitive interface and time-saving automation, it simplifies bookkeeping without sacrificing control.

Review:

Moneybird stands out with its smart invoicing system, customizable templates, and seamless bank integration. It automates recurring tasks like invoice reminders, VAT calculations, and expense categorization. Whether you work solo or with an accountant, Moneybird offers the transparency and features needed to stay financially organized and compliant.

Features of Moneybird:

- Custom invoicing with branded templates

- Automated expense tracking and categorization

- VAT reporting and tax compliance tools

- Bank feed integration and reconciliation

- Accountant collaboration and multi-user access

Final Verdict:

Moneybird is an excellent fit for self-employed professionals who want easy control over their finances. Its focus on automation, professional invoicing, and simplicity makes it a popular choice for service-based businesses and startups.

Pros of Moneybird:

- Very easy to set up and use

- Clean, customizable invoicing tools

- Strong VAT and tax support

- Affordable for freelancers and small teams

Cons of Moneybird:

- Not suited for large or product-based businesses

- Limited inventory or project management tools

- Some features require higher-tier plans

#9 –Kleisteen – Best for Non-Profits and Small Businesses Seeking Simplicity

Kleisteen is a Dutch accounting solution known for its simplicity and focus on non-profits, freelancers, and small businesses. It provides essential tools for bookkeeping, invoicing, and donor tracking in a user-friendly environment—ideal for organizations that need clarity without complexity.

Review:

Kleisteen stands out for offering tailored features for associations and foundations, such as fund accounting, budget tracking, and donor management. For small businesses, it supports invoicing, expense tracking, VAT reporting, and bank integration. The platform’s clean design and easy workflows make it a reliable choice for users with minimal accounting knowledge.

Features of Kleisteen:

- Basic bookkeeping and invoicing tools

- Fund and project tracking for non-profits

- VAT compliance and reporting

- Donor and membership management

- Easy accountant collaboration

Final Verdict:

Kleisteen is a practical and budget-friendly solution for small organizations and non-profits that need streamlined financial management. With its simple tools and nonprofit-specific features, it helps users stay organized and compliant without being overwhelmed.

Pros of Kleisteen:

- Tailored for non-profits and small businesses

- Simple and clean interface

- Solid donor and fund tracking features

- Affordable pricing structure

Cons of Kleisteen:

- Limited scalability for fast-growing companies

- Fewer integrations compared to major competitors

- Lacks advanced automation features

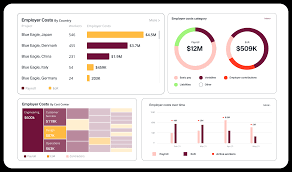

#10–Papaya Global – Best for Global Workforce Compliance

Papaya Global is a leading payroll and workforce management platform designed to simplify global payroll compliance for companies operating across multiple countries. Its cloud-based system provides a unified dashboard to manage payroll, benefits, taxes, and contractor payments in real-time, ensuring businesses stay compliant with local laws and regulations worldwide. Papaya Global is ideal for enterprises looking to streamline complex international workforce operations with transparency and accuracy.

Review:

Papaya Global excels at handling the complexities of global payroll by offering automated compliance monitoring, real-time reporting, and multi-currency payroll processing. The platform supports hiring, onboarding, and paying employees and contractors in over 140 countries, providing businesses with centralized control and detailed insights. Its intuitive interface reduces administrative burden while ensuring accuracy and timely payments.

Features of Papaya Global:

- Global payroll automation and compliance

- Multi-country, multi-currency support

- Contractor management and payments

- Real-time reporting and analytics

- Integration with HRIS and accounting software

Final Verdict:

Papaya Global is a top choice for businesses with international workforces needing reliable, compliant payroll solutions. Its comprehensive platform simplifies global workforce management, offering scalability and ease of use. For companies expanding globally or managing remote teams, Papaya Global reduces risk and administrative complexity with its powerful automation and compliance tools.

Pros of Papaya Global:

- Extensive global compliance coverage

- Supports employees and contractors worldwide

- Robust reporting and analytics

- Seamless integrations with major HR and accounting systems

Cons of Papaya Global:

- Pricing may be high for small businesses

- Learning curve for advanced features

- Limited customization in some modules

#11 – FreeAgent Payroll – Best for Freelancers and Contractors

FreeAgent Payroll caters specifically to freelancers, contractors, and small business owners who need a simple payroll system with accounting features built-in. It is designed to reduce the time spent on tax and payroll tasks while keeping compliance in check. FreeAgent’s interface is clean and intuitive, making it easy for non-accountants to manage payments.

Review:

The software automates tax calculations, RTI submissions, and pension contributions. Its integration with FreeAgent accounting software provides a unified platform for invoicing, expenses, and payroll. Users appreciate the real-time HMRC updates and efficient customer support, especially for self-employed professionals juggling multiple responsibilities.

Features of FreeAgent Payroll:

- Simple RTI payroll submissions

- Automatic pension enrolment and contributions

- Integration with FreeAgent accounting and invoicing

- Payslip generation and employee self-service

- Cloud-based access for anywhere management

Final Verdict:

FreeAgent Payroll is an excellent choice for freelancers and contractors who want to manage their payroll with minimal fuss. Its tight integration with accounting tools and clear compliance features help reduce errors and free up time to focus on business growth.

Pros of FreeAgent Payroll:

- Designed specifically for freelancers and small businesses

- Seamless integration with FreeAgent accounting

- Easy-to-use interface

- Cloud-based with remote access

- Strong customer support

Cons of FreeAgent Payroll:

- Limited features for larger businesses

- No advanced reporting options

- Not suited for complex payroll needs

- Pricing may be higher for very small teams

- Lacks extensive customization

#12 – Reed HR Payroll Software – Best for HR Teams Needing Built-In Payroll Support

Reed HR Payroll Software combines core payroll functionality with embedded HR tools, catering to businesses that require integrated employee management. It is well-suited for HR teams looking to streamline payroll while managing recruitment, absence, and compliance within one system. The software supports a range of industries and is praised for its configurability and reporting.

Review:

Reed HR Payroll Software offers a comprehensive platform with payroll at its core, surrounded by strong HR capabilities. The system automates pay calculations, pension contributions, and tax reporting, while also managing employee data, holidays, and appraisals. Users appreciate the centralized system that reduces duplication and improves data accuracy.

Features of Reed HR Payroll Software:

- Integrated payroll and HR management tools

- Automated RTI submissions and pension auto-enrolment

- Employee self-service portals

- Recruitment and absence management modules

- Detailed compliance and audit reporting

Final Verdict:

Reed HR Payroll Software is ideal for businesses where HR teams want payroll tightly woven into employee management. It delivers solid payroll functions alongside versatile HR tools, improving workflow efficiency and data consistency.

Pros of Reed HR Payroll Software:

- Strong integration of payroll and HR

- Flexible and configurable system

- Good support for compliance and reporting

- Employee self-service features

- Suitable for mid-sized businesses

Cons of Reed HR Payroll Software:

- Can be complex to set up initially

- Pricing may be higher than standalone payroll software

- User interface can feel dated

- Learning curve for HR modules

- Limited mobile capabilities

#13 – Pento – Best for Modern, Real-Time Payroll Automation

Pento is a modern cloud-based payroll system that emphasizes automation and real-time processing. It’s designed to save time by integrating with accounting software and automating repetitive payroll tasks, making it a great option for companies wanting to simplify payroll while improving accuracy and compliance.

Review:

Pento offers real-time payroll calculations and automatic tax submissions, reducing manual input and errors. It supports multiple pay runs, employee self-service, and integrates smoothly with popular accounting platforms. The intuitive interface and automation features make Pento appealing to HR and finance teams focused on efficiency and compliance.

Features of Pento:

- Real-time payroll processing and reporting

- Automatic RTI submissions and tax calculations

- Integration with accounting software like Xero and QuickBooks

- Employee self-service and payslip access

- Automated pension enrolment and compliance alerts

Final Verdict:

Pento is an excellent choice for businesses looking to automate payroll with a modern, cloud-first approach. Its real-time capabilities and integrations save time and reduce risk, making it suitable for fast-growing companies and those who value automation.

Pros of Pento:

- Real-time, automated payroll processing

- Easy integration with accounting tools

- User-friendly cloud interface

- Strong compliance features

- Excellent support and onboarding

Cons of Pento:

- May lack advanced HR features

- Pricing higher than some traditional payroll providers

- Limited customization for complex payroll scenarios

- Smaller app ecosystem compared to legacy systems

- Best suited for tech-savvy users

#14 – Staffology – Best for Flexible, API-Friendly Cloud Payroll

Staffology is a cloud-native payroll platform known for its flexibility and powerful API integrations. It caters to payroll providers, accountants, and businesses that require customizable solutions and want to automate workflows through third-party software connections. Staffology blends compliance with developer-friendly tools.

Review:

Staffology excels at providing a scalable and flexible payroll system that integrates well with various accounting and HR software via its open API. It offers full compliance with HMRC and supports complex payroll needs, including pensions and benefits management. The platform is praised for its ease of use and excellent customer service.

Features of Staffology:

- Full cloud payroll with open API access

- Automated RTI submissions and pension auto-enrolment

- Integration with accounting and HR systems

- Employee self-service and payslip delivery

- Customizable workflows and reports

Final Verdict:

Staffology is ideal for businesses and payroll bureaus that need a cloud-based, flexible payroll system with extensive integration capabilities. Its developer-friendly environment and strong compliance make it a future-proof choice for modern payroll management.

Pros of Staffology:

- Flexible and developer-friendly with API access

- Cloud-based for accessibility and updates

- Strong UK compliance and pension management

- User-friendly interface and support

- Good for payroll bureaus and accountants

Cons of Staffology:

- Requires technical know-how to maximize API benefits

- Smaller market share compared to bigger names

- Limited built-in HR features

- Learning curve for non-technical users

- Customization may need developer input