The financial-services sector is entering a new era—one defined by tighter regulations, global hiring, digital transformation, and increasing pressure to deliver flawless employee and client experiences. Banks, investment firms, fintech startups, wealth-management firms, and insurance companies must now navigate environments where compliance mistakes cost millions, talent is hard to retain, and HR operations must move as fast as the markets themselves.

This is why, in 2026, choosing the right HR software is more than operational convenience—it is a risk management strategy, a compliance shield, and a competitive advantage. The best HR platforms for financial services not only streamline HR tasks but also protect sensitive data, automate mandatory compliance steps, simplify multi-layered compensation structures, and ensure every employee’s records are audit-ready at all times.

If you work in banking, fintech, advisory, insurance, or any financial institution, this guide will help you choose the HR system that matches your complexity, workforce model, and growth strategy.

Why HR Software Has Become Essential for Financial Institutions

Financial companies deal with sensitive employee records, regulatory standards, and complex organizational structures. As a result, HR processes must be flawless, secure, and consistently audit-ready. Manual systems no longer meet the demands of continuous inspections, data-protection mandates, or multi-layer payroll calculations.

Modern HR platforms help financial institutions:

- Centralize employee data, ensuring secure, encrypted access for audits.

- Automate compliance workflows, reducing risks during inspections.

- Standardize onboarding processes, especially when roles require certifications.

- Track performance precisely for regulated positions.

- Manage workforce planning, budgeting, and staffing with real-time analytics.

The financial industry is especially dependent on documented, traceable processes — and HR software delivers that consistency.

How This List Was Compiled

Financial services require HR systems with much higher standards than typical industries.

To build a reliable, authoritative list, each HR software was evaluated using strict criteria specific to the financial sector. We analyzed:

- Security standards & access control (encryption, multi-factor authentication, SOC 2, ISO certifications)

- Compliance capabilities (audit trails, documentation, certifications & regulation tracking)

- Payroll complexity handling (commissions, bonuses, multi-state and multi-country payroll)

- Risk management features (permission controls, automated logs, digital recordkeeping)

- Scalability across branches, departments & regions

- Integration with tools used by financial teams (CRM, accounting software, IT systems)

- Support for hybrid, remote & global workforce models

Only software platforms that matched financial-grade standards were included in this 2026 ranking.

Top 10 Best HR Software for Financial Services in 2026

Below is the selected list of the top-performing, most secure, and most reliable HR systems trusted across banking, fintech, investment, and financial institutions:

- Workday HCM — Best Enterprise-Level HR System for Large Financial Institutions

- BambooHR — Best All-Around HR Suite for Small to Mid-Sized Financial Firms

- ADP Workforce Now — Best Payroll & Compliance Solution for Complex Compensation

- Rippling — Best for Automated Compliance & HR + IT Integration

- UKG Ready (Kronos) — Best for Workforce Forecasting, Time & Attendance

- SAP SuccessFactors — Best HRIS for Multinational Financial Enterprises

- Gusto — Best HR + Payroll Platform for Small Financial Teams & Advisors

- HiBob (Bob) — Best for Culture-Driven, Hybrid & Digital-First FinTechs

- Paychex Flex — Best for Compliance-Heavy Financial Operations

- Factorial HR — Best for Global Hiring, Documentation & Audit Readiness

1. Workday HCM

Overview

Workday HCM is one of the most advanced and enterprise-focused HR systems used across major banks, multinational financial institutions, insurance groups, and global investment firms. Known for its deep analytics, intelligent automation, and extremely strong compliance infrastructure, Workday supports complex workforce structures with thousands of employees across multiple countries. It unifies HR, payroll, talent management, benefits, and workforce planning into integrated ecosystem.

Key Features

- Intelligent workforce analytics and forecasting

- Advanced security with role-based permissions

- Global payroll support and compliance automation

- Centralized documentation and digital audit trails

- AI-driven talent, recruiting, and performance management

-

Seamless integration with financial systems and IT tools

Review

Workday offers unmatched reliability for large, highly regulated institutions. Its greatest strength is its ability to connect HR data with financial data, giving organizations a full 360-degree view of workforce performance, payroll costs, turnover risks, and staffing demands. Banks and financial enterprises particularly value Workday’s compliance capabilities.

Pros

- Extremely secure and compliant

- Best-in-class analytics and forecasting

- Ideal for multinational financial institutions

- Unified HR, payroll, and workforce management

- Highly reliable for large-scale operations

Cons

- Expensive for small firms

- Requires expert-led setup

- Complex learning curve for beginners

Final Verdict

Workday is the strongest enterprise HR solution for the financial sector, offering unmatched compliance standards, intelligent reporting, and global workforce management capabilities. It is best suited for banks and large financial groups.

2. BambooHR

Overview

BambooHR is a widely trusted HR platform designed for small to medium-sized financial firms, including advisory firms, boutique investment agencies, insurance teams, and growing fintech companies. It delivers a clean and intuitive experience while providing all core HR tools such as onboarding, performance management, employee records, and simple payroll add-ons. BambooHR shines in environments where teams need organization, clarity, and smooth employee experiences.

Key Features

- Centralized employee records and secure data storage

- Smooth onboarding and document collection workflows

- Time tracking and performance management tools

- Optional payroll and benefits administration

- Role-based permissions and compliance reporting

- User-friendly dashboard for HR and employees

Review

BambooHR consistently stands out for its simplicity and high-quality user experience. Financial firms appreciate its structured workflows and clean dashboard, which reduce administrative workload and help HR teams stay organized. While it may not have the depth of Workday or SAP, it handles the needs of small to mid-sized financial firms exceptionally well.

Pros

- Very easy to use

- Great for small and mid-sized financial firms

- Clean interface and organized workflows

- Strong onboarding and document management

-

Affordable compared to enterprise HR platforms

Cons

- Not ideal for very large institutions

- Limited advanced analytics

- Global payroll support is limited

Final Verdict

BambooHR is a perfect match for smaller financial services teams that want a user-friendly HR system without unnecessary complexity. It supports all essential HR workflows reliably, improves employee organization, and helps firms maintain compliance while keeping costs low.

3. ADP Workforce Now

Overview

ADP Workforce Now is a robust HR and payroll system built for organizations that need extremely reliable payroll processing, tax compliance, and benefits administration. Because ADP specializes in handling complex compensation structures — including commissions, bonuses, multi-state tax filings, and regulatory deductions — it has become a leading choice for financial firms. Its tools support HR teams in managing sensitive payroll data while maintaining accurate compliance records.

Key Features

- Advanced payroll automation for complex compensation

- Secure employee database and compliance tracking

- Benefits administration and integrated tax filing

- Time, attendance, and workforce scheduling

- Role-based access controls for sensitive financial data

-

HR analytics and reporting dashboards

Review

ADP Workforce Now is a highly dependable system for financial organizations that prioritize payroll accuracy and regulatory compliance. Its payroll engine is one of the strongest in the market, offering precise rule-based calculations suitable for financial analysts, agents, brokers, and commission-based staff. The system is designed to handle growth and regulatory changes smoothly.

Pros

- Industry-leading payroll accuracy

- Excellent compliance and tax automation

- Reliable for multi-state and multi-branch operations

- Strong reporting and audit support

-

Scalable for large teams

Cons

- Interface feels outdated

- Customization options limited

- Add-ons increase cost

Final Verdict

ADP Workforce Now is ideal for financial firms where payroll, commissions, and regulatory reporting are top priorities. Its accuracy and dependability make it a long-term, reliable choice for firms that want a safe and compliant HR foundation.

4. Rippling

Overview

Rippling is a modern HR platform that excels at automated compliance, IT integration, and unified workforce management. Financial institutions appreciate Rippling because it goes beyond traditional HR functions — it also connects employee onboarding with device management, app provisioning, and security controls. This makes it ideal for fintech companies, investment firms, digital banks, and remote-first financial teams that depend on secure technology setups.

Key Features

- Automated HR, payroll, and compliance workflows

- IT and app management for onboarding and offboarding

- Global payroll support and workforce structuring

- Role-based permissions and secure access control

- Policy automation and digital audit documentation

-

Deep integrations with financial software tools

Review

Rippling is one of the most innovative HR systems available for financial organizations that prioritize automation and security. Its ability to connect HR and IT allows firms to manage access to trading platforms, financial tools, and internal systems with ease. Compliance automation is a standout strength, helping firms maintain consistent documentation across teams.

Pros

- Excellent automation capabilities

- Strong IT + HR integration

- Great for fast-growing fintechs

- Reliable compliance features

-

Highly customizable modules

Cons

- Can become expensive with multiple modules

- Not as enterprise-focused as Workday

-

Setup requires time and technical configuration

Final Verdict

Rippling is a top solution for modern financial companies that depend on both strong HR management and secure IT operations. Its automation, flexibility, and scalability make it especially valuable for fintech startups and digital financial organizations.

5. UKG Ready

Overview

UKG Ready (formerly Kronos) is a workforce management platform known for its powerful time tracking, attendance management, and labor forecasting features. Financial institutions with multiple branches, rotating shifts, and complex staffing schedules rely on UKG Ready to maintain accuracy and workforce efficiency. The system is designed to help organizations monitor employee activity, manage shifts, and ensure compliance with labor regulations, making it ideal for banks, and customer-facing financial staff.

Key Features

- Advanced time and attendance tracking

- Labor forecasting and scheduling tools

- Compliance alerts and workforce auditing

- Secure employee records and document storage

- Integrated payroll and HR capabilities

-

Strong workforce analytics and reporting

Review

UKG Ready excels in environments where time management and labor allocation directly impact customer service and operational efficiency. Financial organizations appreciate its accuracy in tracking attendance, scheduling staff, and predicting labor needs based on workload patterns. The platform provides clear data insights, helping managers.

Pros

- Industry-leading time & attendance tools

- Great for banks and multi-branch teams

- Strong compliance and documentation tracking

- Reliable forecasting features

- Integrates well with payroll systems

Cons

- Interface can be complex

- Better suited for mid-sized to large firms

- Setup may require training

Final Verdict

UKG Ready is the best option for financial institutions where labor tracking, forecasting, and attendance accuracy are essential. Its depth of features makes it particularly useful for banks, call centers, and multi-location financial teams.

6. SAP SuccessFactors

Overview

SAP SuccessFactors is a full-scale, enterprise-grade HRIS built for large and multinational financial institutions that require deep workforce analytics, global compliance support, and scalable HR workflows. With its cloud-based infrastructure and modular design, SuccessFactors integrates core HR, payroll, learning, recruiting, performance management, and succession planning into one centralized ecosystem. Financial companies especially benefit from its advanced compliance mapping and audit logs.

Key Features

- Workforce analytics with predictive modeli.

- Global HR compliance framework and localization tools

- Performance, learning, and succession management

- End-to-end recruiting with AI screening

- Integrated payroll and time-tracking modules

-

Mobile-first employee experience

Review

SAP SuccessFactors stands out for its unmatched enterprise capability, especially when handling complex HR infrastructures across multiple regions. Financial enterprises value its audit-readiness, regulatory adherence, and granular permissions structure supporting strict oversight protocols. The system is robust, highly scalable, and backed by SAP’s powerful data architecture.

Pros

- Extremely scalable for global, multi-entity financial firms

- Strong audit, compliance, and documentation tools

- Deep analytics ideal for data-driven leadership

- Modular system — purchase only what you need

-

World-class performance and succession planning

Cons

- Expensive and resource-heavy to implement

- Steep learning curve for non-technical HR teams

- Customization sometimes requires SAP-certified partners

Final Verdict

SAP SuccessFactors is best suited for large financial enterprises with complex international workforces and advanced compliance obligations. Firms that want a long-term, deeply integrated, enterprise-grade HR ecosystem will find SuccessFactors unmatched in capability and power.

7. Gusto

Overview

Gusto is a simple, modern, and user-friendly HR and payroll platform designed for small financial teams, independent advisors, accounting firms, wealth consultants, and boutique finance agencies. It emphasizes payroll automation, tax filings, benefits administration, and onboarding tools—all packaged in an intuitive interface. For smaller financial operations that want simplicity without sacrificing reliability, Gusto provides everything needed to manage core HR functions without overwhelming complexity or cost.

Key Features

- Automated payroll and tax filing

- Employee onboarding and document management

- Affordable benefits administration

- Time tracking + scheduling tools

- Contractor management and payments

-

Simple HR reporting and compliance alerts

Review

Gusto excels in ease of use, payroll reliability, and affordability. For small financial agencies, it provides all essential HR operations without forcing them into enterprise-level systems. Payroll accuracy, automated tax compliance, and smooth onboarding make it a trusted tool in industries where errors can be costly. It performs extremely well.

Pros

- Very easy for small teams to adopt

- Affordable compared to enterprise HR systems

- Strong payroll accuracy and tax compliance

- Smooth onboarding and contractor support

- Excellent customer service and user-friendly UI

Cons

- Not suitable for large or multinational teams

- Limited advanced HR analytics

- Fewer customization options compared to bigger HR suites

Final Verdict

Gusto is ideal for small financial teams that need reliable payroll, hiring, compliance support, and basic HR management. It offers simplicity, automation, and affordability without unnecessary complexity.

8. HiBob (Bob)

Overview

HiBob (Bob) is a modern HR platform designed for digital-first, hybrid, and culture-centric organizations—making it a perfect fit for fintechs, neobanks, digital brokers, and remote-first financial service providers. Bob places strong emphasis on employee engagement, culture-building, organizational transparency, and modern workflows, giving companies a people-focused HR foundation that scales with growth.

Key Features

- Culture and engagement analytics

- Performance, goals, and feedback cycles

- Remote-friendly onboarding and workflows

- Global HR support for multi-country teams

- Compensation management tools

-

Customizable employee hubs and dashboards

Review

Bob is highly appealing to tech-forward financial organizations that value flexibility, culture, and modern HR design. Its interface is interactive and built to support globally distributed teams. While it does not specialize in heavy enterprise compliance like Workday or SAP, it excels at boosting employee engagement, creating cohesive digital workplaces, and supporting hybrid structures.

Pros

- Excellent for hybrid and global-first financial teams

- Strong culture and engagement tools

- Fantastic user interface

- Easy to configure and adopt

-

Great visibility into team performance and sentiment

Cons

- Limited payroll functionality without integrations

- Not as compliance-heavy as traditional HRIS

- Pricing can increase with add-ons

Final Verdict

HiBob is ideal for fintech companies and digital-first financial teams that want a modern, engaging, culture-centric HR platform to support rapid scaling and distributed operations.

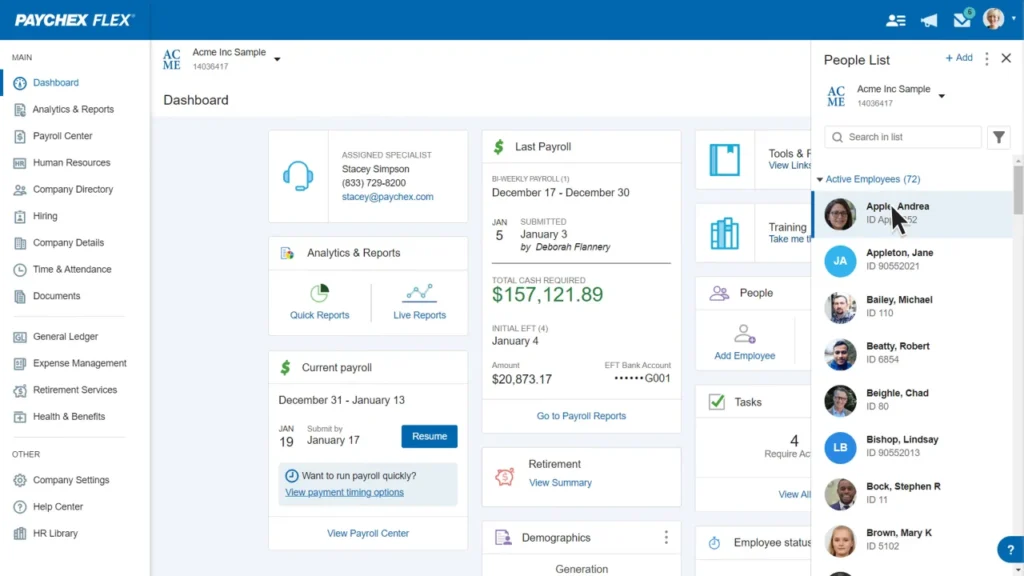

9. Paychex Flex

Overview

Paychex Flex is a compliance-focused HR and payroll system that serves financial organizations requiring strict regulatory oversight, detailed recordkeeping, and accurate payroll workflows. Banks, insurance firms, lending offices, and advisory firms benefit from its strong compliance measures, built-in documentation controls, and reliable tax and payroll management. It provides a balanced combination of HR tools, risk management, time tracking, and advanced payroll.

Key Features

- Compliance-focused HR administration

- Automated tax filing and payroll corrections

- Time and attendance monitoring

- Employee training and recordkeeping

- Benefits and retirement plan support

- Robust HR reporting and audit logs

Review

Paychex Flex is particularly valued in industries with sensitive payroll and compliance standards like finance. Its strong documentation workflows, high accuracy in payroll, and regulatory tools make it ideal for firms that require strict adherence to federal and state guidelines. While the interface is less modern than newer HR tech platforms, its reliability and compliance strength outweigh design limitations for many firms.

Pros

- Very strong compliance and risk management tools

- Highly reliable payroll processing

- Good benefits and retirement plan support

- Suitable for small to mid-size financial firms

- Detailed audit logs and recordkeeping

Cons

- Interface can feel outdated

- Customer support response times vary

- Fewer modern engagement tools

Final Verdict

Paychex Flex is best suited for financial organizations that prioritize compliance, payroll accuracy, and regulatory readiness. It provides peace of mind for firms that operate under strict legal and financial scrutiny.

10. Factorial HR

Overview

Factorial HR is a modern, global-ready HR platform built for financial firms that operate across multiple countries, hire internationally, or require strong document management and compliance automation. With an emphasis on global HR operations, Factorial helps small and mid-sized financial companies manage contracts, policies, attendance, and documentation efficiently while maintaining compliance with international labor laws.

Key Features

- Global hiring and multi-country HR workflows

- Centralized document storage and e-signatures

- Time, attendance, and shift tracking

- Performance reviews and feedback cycles

- Custom HR workflows and approvals

- Policy management and compliance alerts

Review

Factorial stands out for its global capability and high adaptability. Financial companies with distributed teams appreciate its document workflows, policy automation, and international compliance features. It is much more user-friendly than older HRIS platforms and offers strong value for money. However, it lacks the deep enterprise capabilities of SAP or Workday,

Pros

- Excellent for global hiring and distributed teams

- Strong document and compliance automation

- Modern and user-friendly interface

- Affordable compared to enterprise systems

-

Highly customizable workflows

Cons

- Limited enterprise-level analytics

- Payroll requires integrations in many regions

- Not ideal for very large financial institutions

Final Verdict

Factorial HR is an excellent option for growing financial service companies and fintech firms operating internationally. It offers a modern, flexible, compliance-friendly HR solution suitable for global scaling.

Conclusion

Choosing the best HR software for financial services in 2026 requires balancing compliance, payroll accuracy, workforce analytics, global HR needs, culture-building, and automation. Financial institutions operate in one of the most heavily regulated industries in the world, which means HR systems must deliver rigor, transparency, and airtight documentation.

The platforms in this list offer solutions for every type of financial organization—from large multinational banks that need enterprise-grade systems like Workday HCM and SAP SuccessFactors, to mid-sized firms requiring flexibility and automation with BambooHR, Rippling, and Factorial HR, to small advisory teams that seek simple and affordable choices like Gusto and Paychex Flex.

Whether you prioritize compliance automation, global workforce management, payroll precision, or employee engagement, you can confidently select from the tools above knowing each one addresses key challenges specific to modern financial services. The right system not only reduces HR workload—it improves accuracy, ensures legal compliance, strengthens workplace culture, and empowers leaders to make smart, data-driven decisions.

Frequently Asked Questions (FAQs)

What HR software is best for large financial institutions?

Workday HCM and SAP SuccessFactors are the top choices for large, multinational financial enterprises. They offer advanced analytics, global compliance tools, strict audit controls, and the ability to manage thousands of employees across multiple regions. Their scalability and regulatory strength make them suitable for banks, insurance corporations, and investment institutions.

Which HR software is best for small financial firms and advisory teams?

Gusto and BambooHR are ideal for smaller financial organizations because they provide simple onboarding, automated payroll, benefits management, and compliance tools without overwhelming features or high pricing. These platforms are very user-friendly and perfect for small advisory firms, accounting offices, and boutique financial agencies.

What features should financial institutions prioritize in HR software?

Financial companies should look for strong compliance workflows, detailed audit trails, accurate payroll, secure document management, global HR support, and analytics for risk monitoring. Because the industry is heavily regulated, tools that automate compliance and reduce errors are essential for safety and operational efficiency.

Is Rippling good for financial services firms?

Yes, Rippling is especially valuable for financial organizations that want automated compliance, IT + HR integration, and fast onboarding. Its device management and access control help maintain data security—critical in finance. It works best for small to medium firms that prefer automation-heavy HR processes.

Can financial companies use HR software for global hiring?

Absolutely. Tools like Factorial HR, HiBob, and SAP SuccessFactors are built for multi-country teams and global hiring. These platforms provide international compliance rules, document workflows, localized contracts, payroll integrations, and cross-border workforce analytics—making it easier for financial firms to expand internationally.